Stocks Treading Water for a Good Reason

Stocks Treading Water for a Good Reason

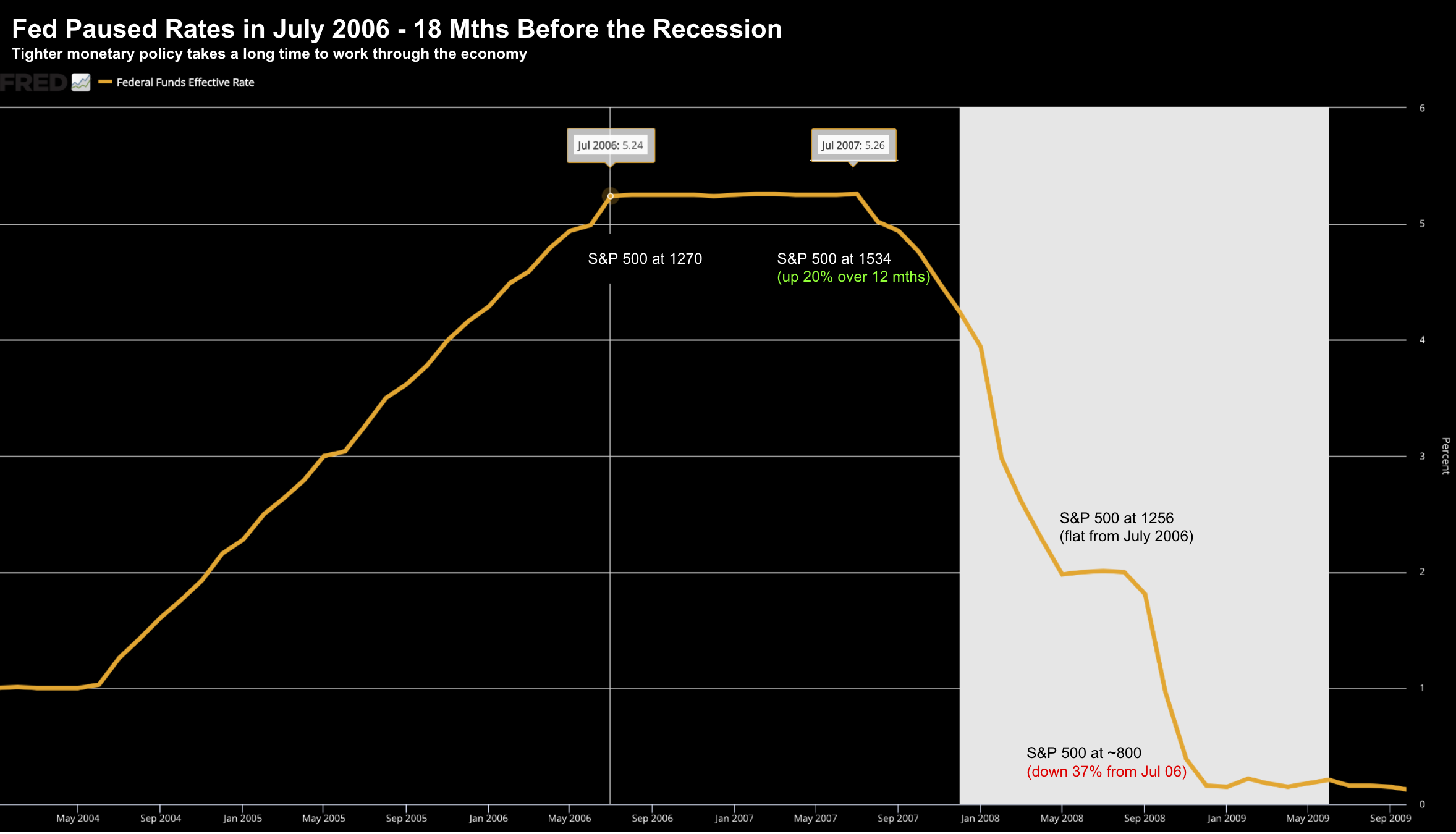

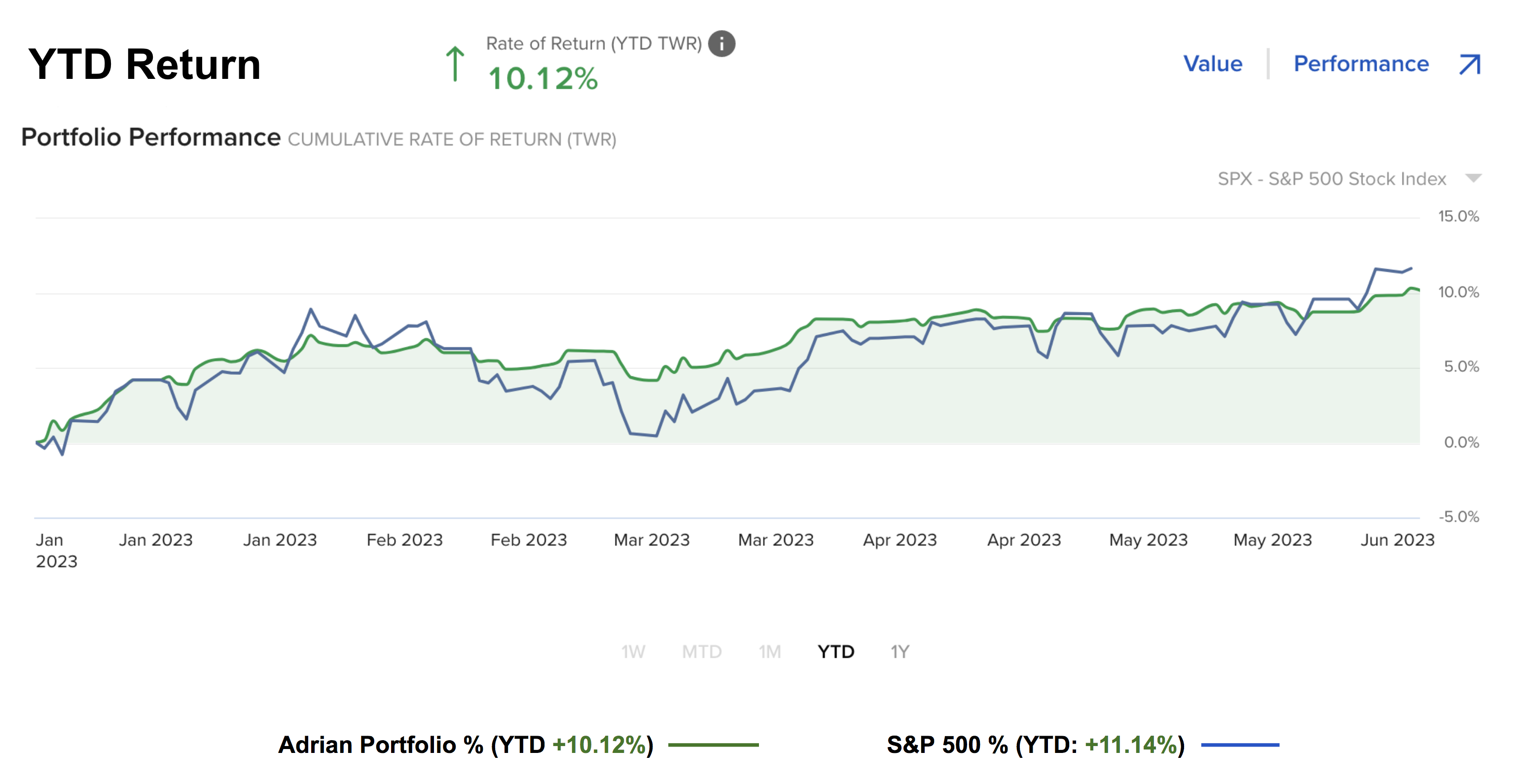

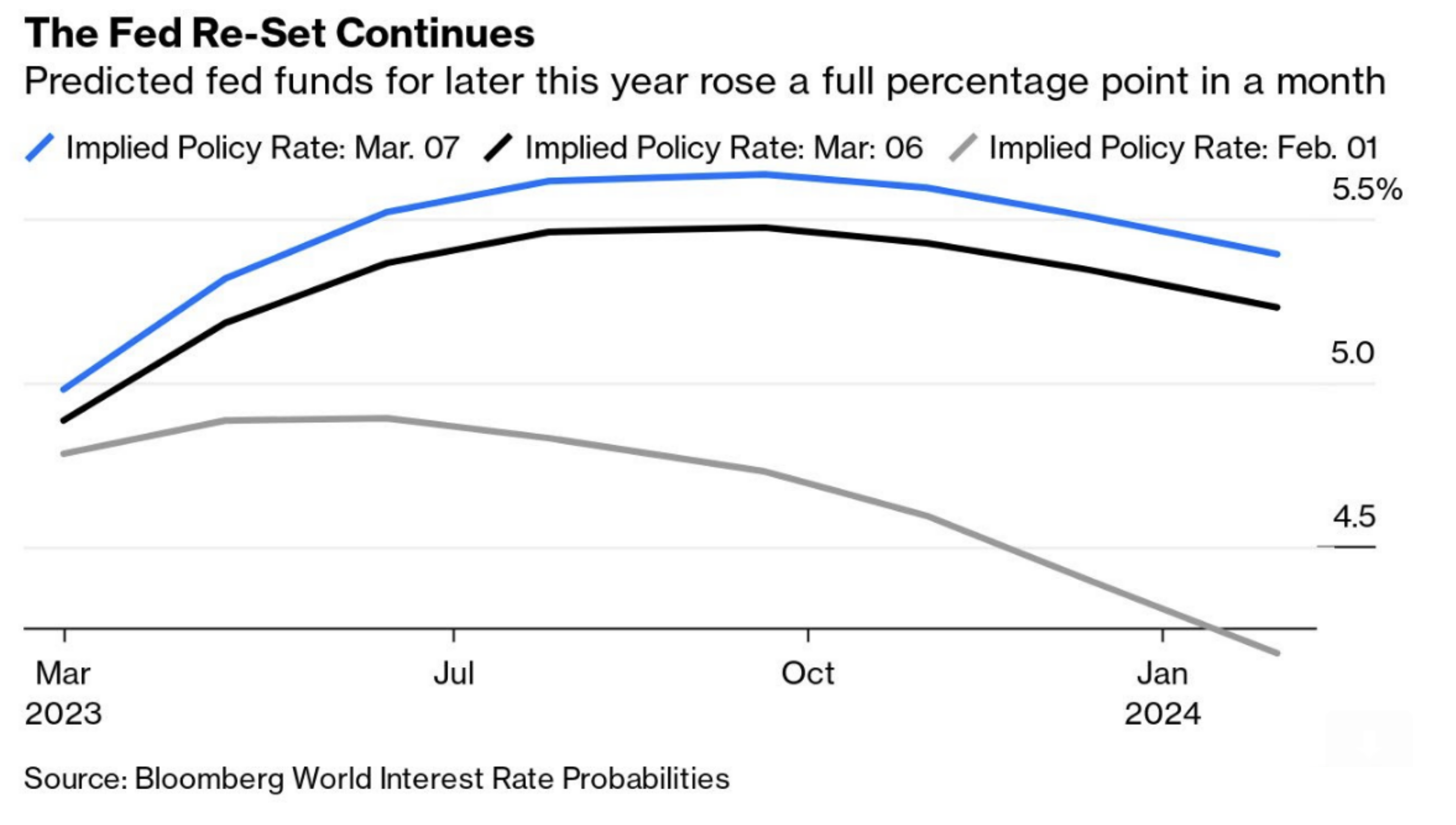

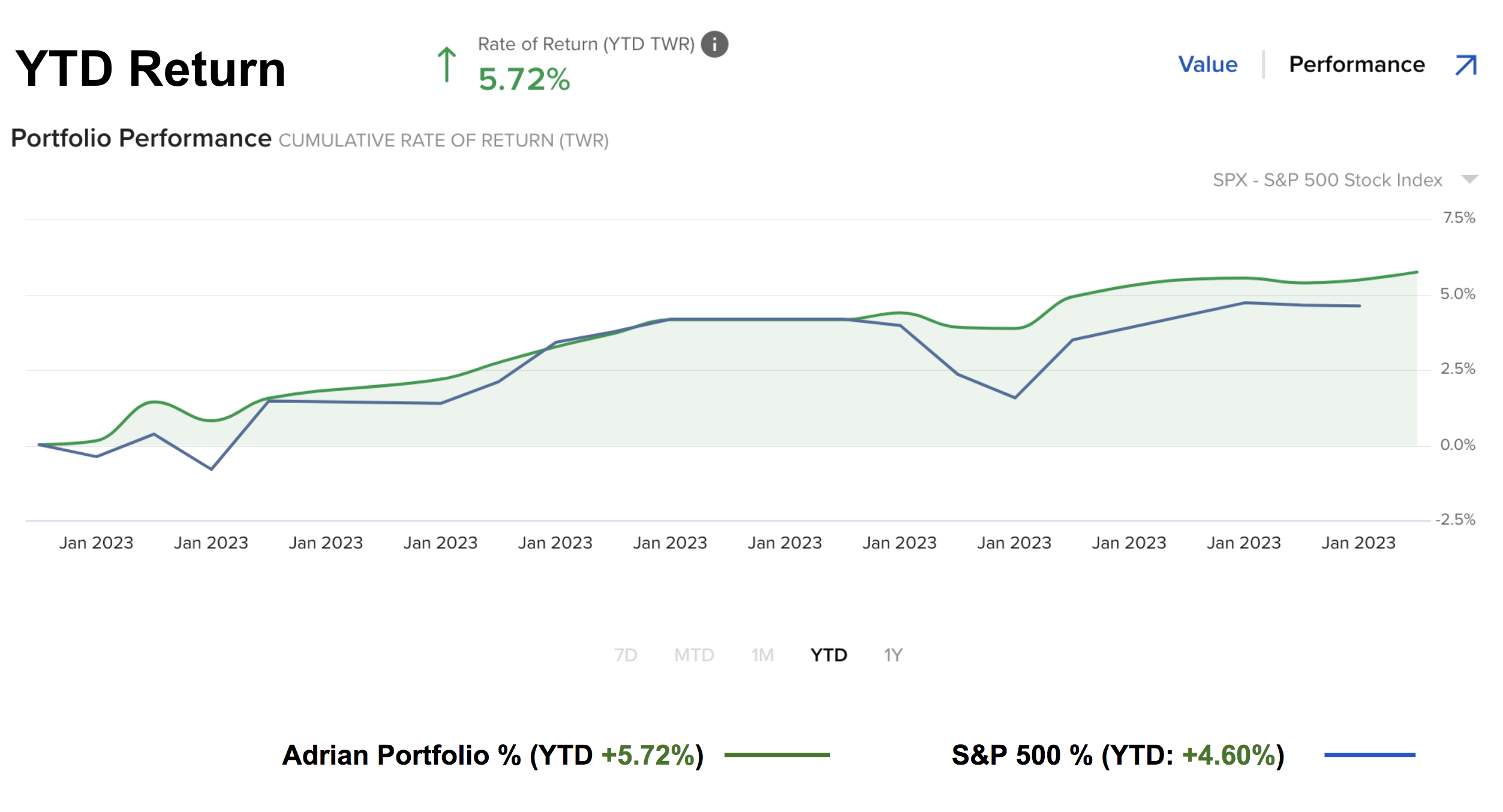

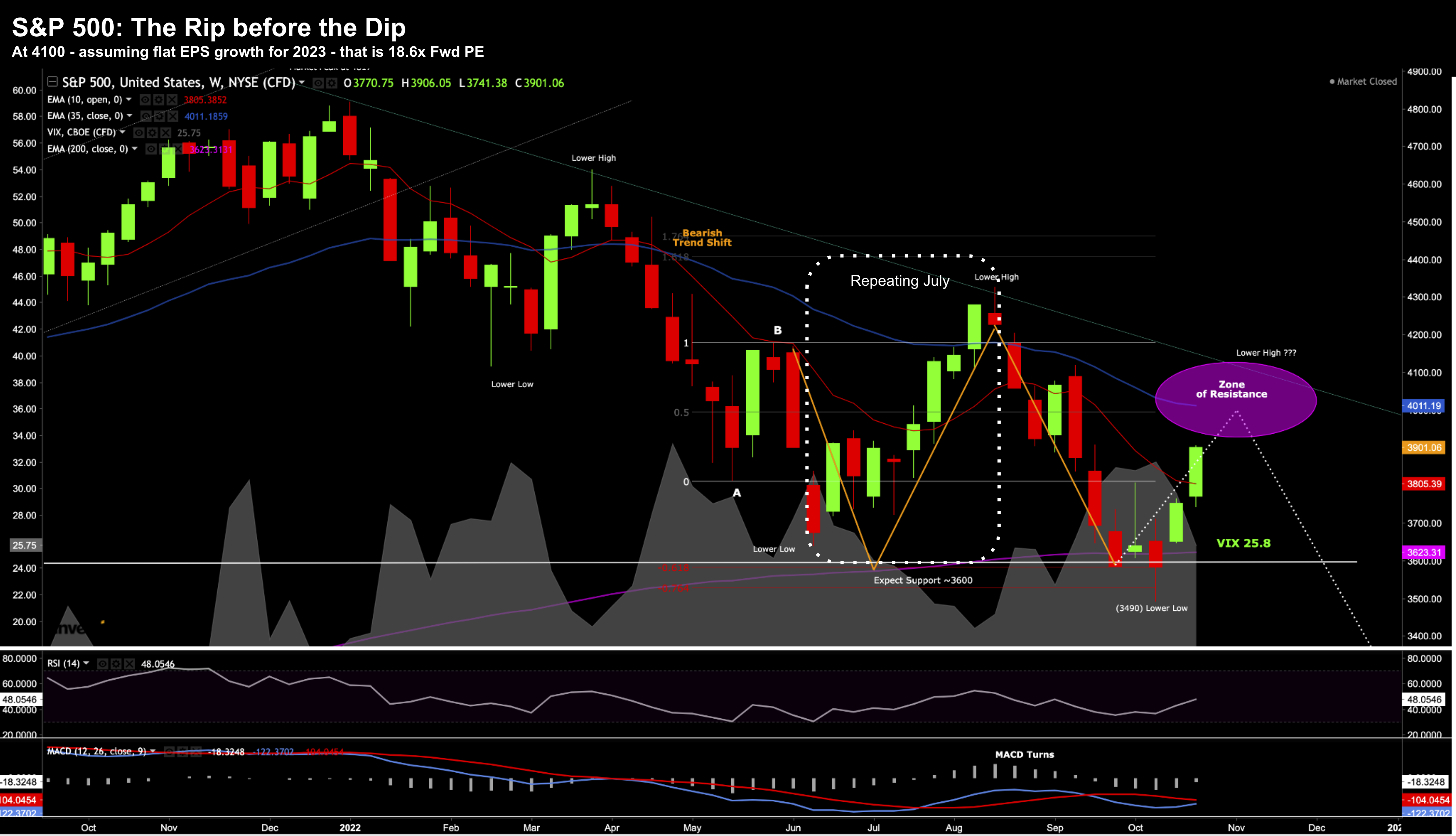

Stocks cannot get out of neutral. If anything, they appear to be going into reverse. Makes sense... they ripped~ 30% higher in 9 short months. But the risks are increasing as prices rise. This post looks at "equity risk premium". In short, investors are not being adequately compensated for the risk being taken in stocks (at current valuations) against the risk free return from Treasuries.