12 Stocks to Own on any “Panic Selling”

12 Stocks to Own on any “Panic Selling”

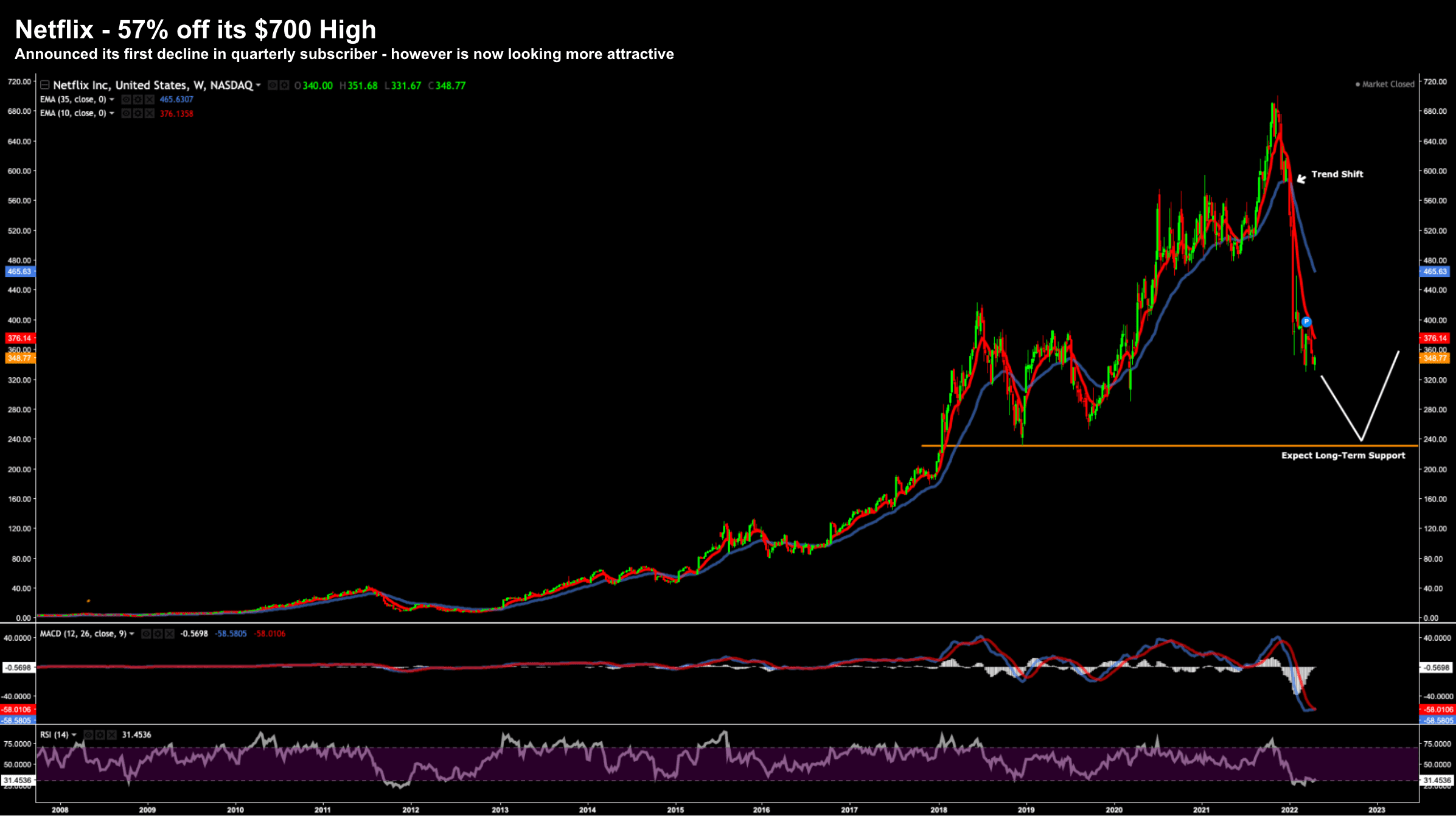

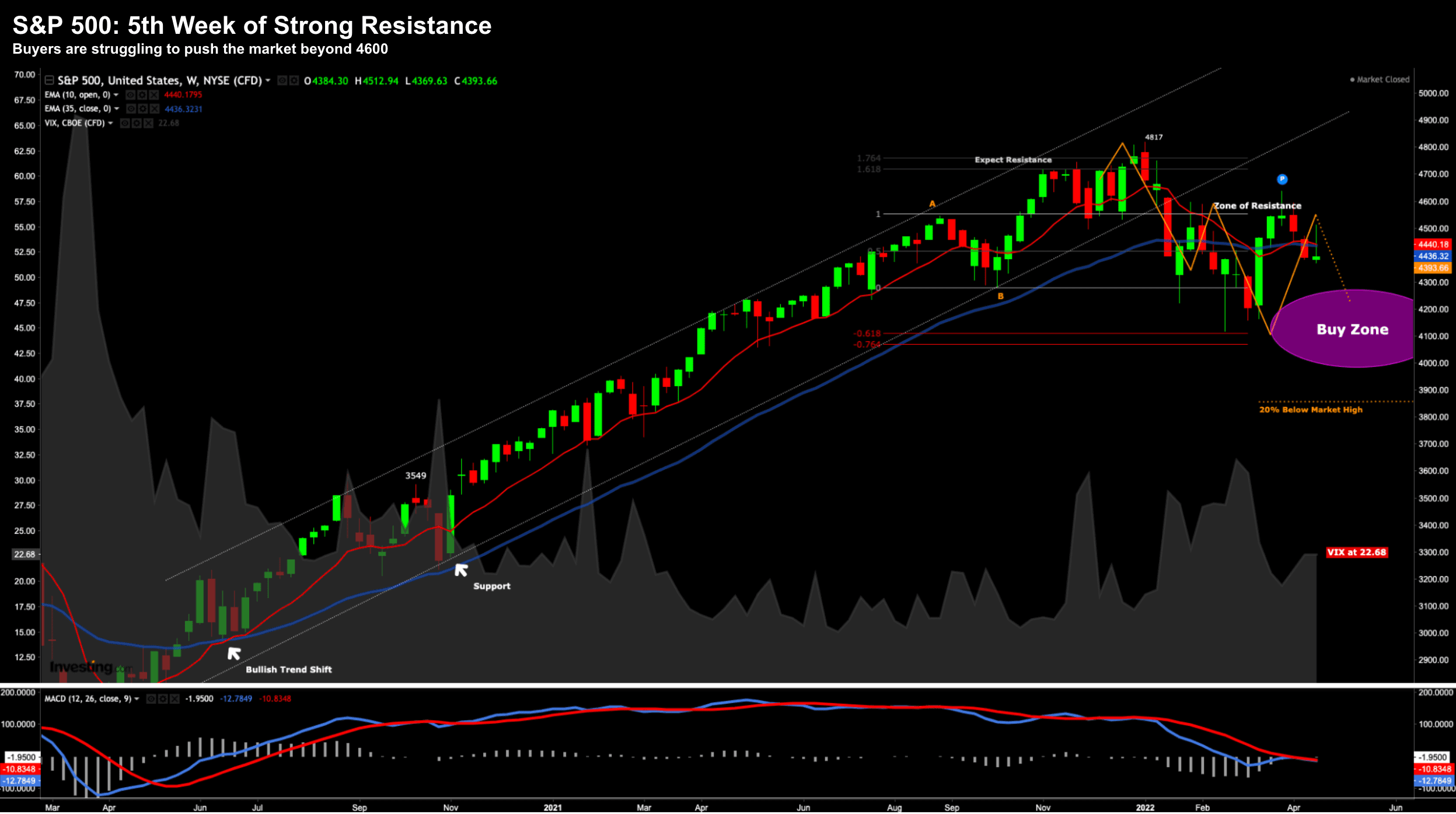

If you are investing today - you need to remain extremely selective with stocks. Look at the decimation in names like Facebook and Netflix. This post offers my checklist when selecting a stock....