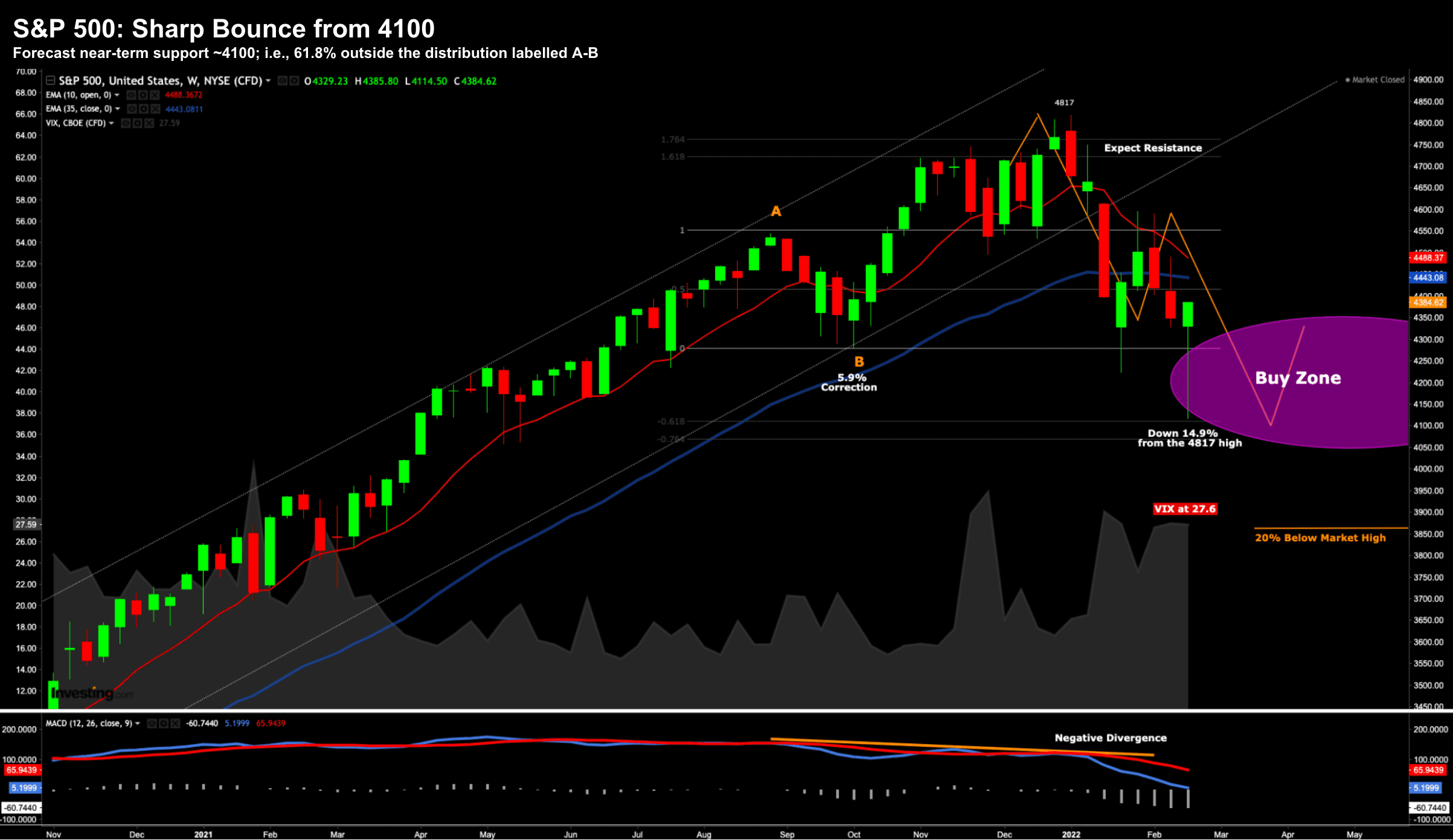

Nothing Changes after Today’s Surge Higher

Nothing Changes after Today’s Surge Higher

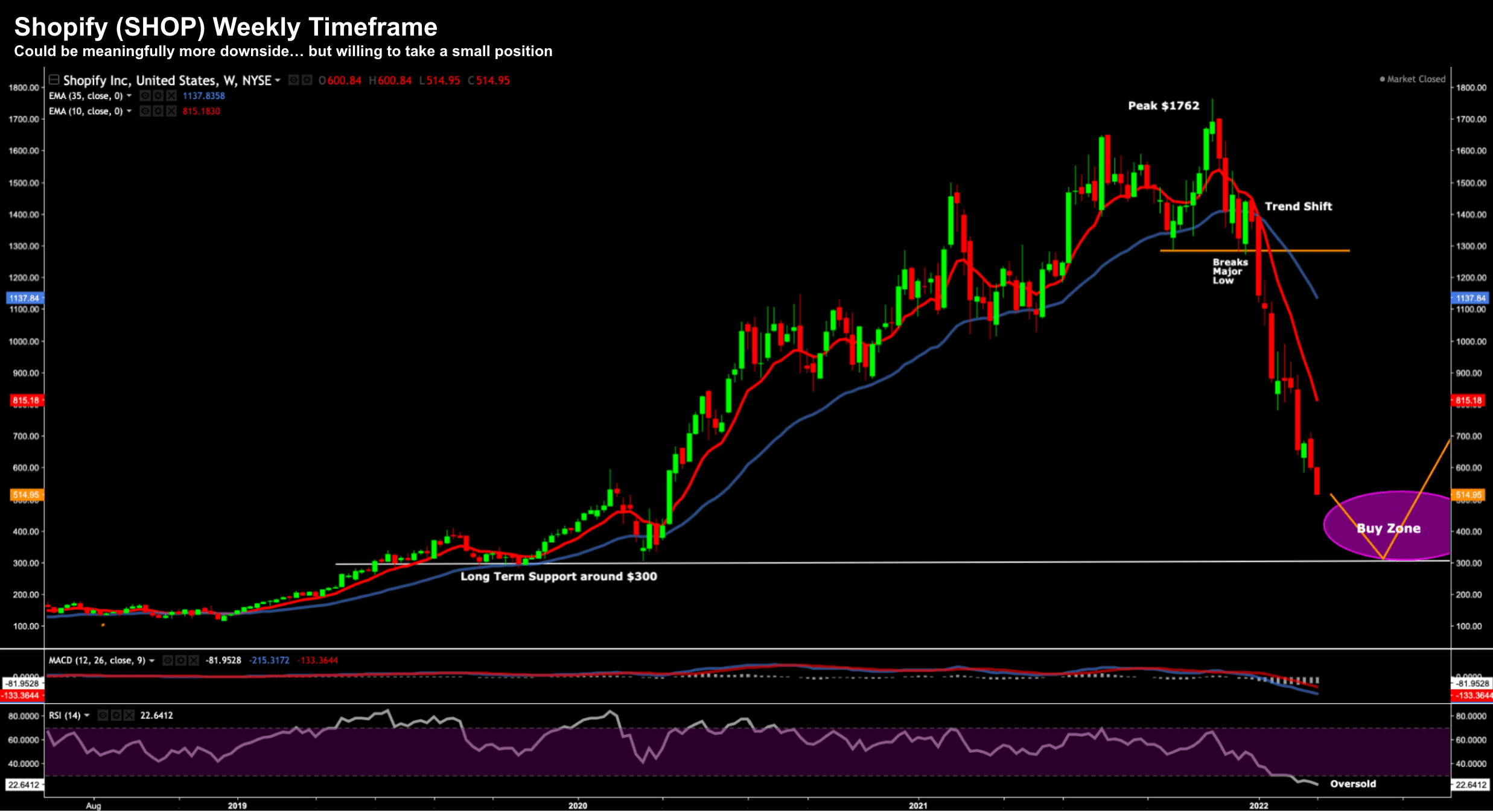

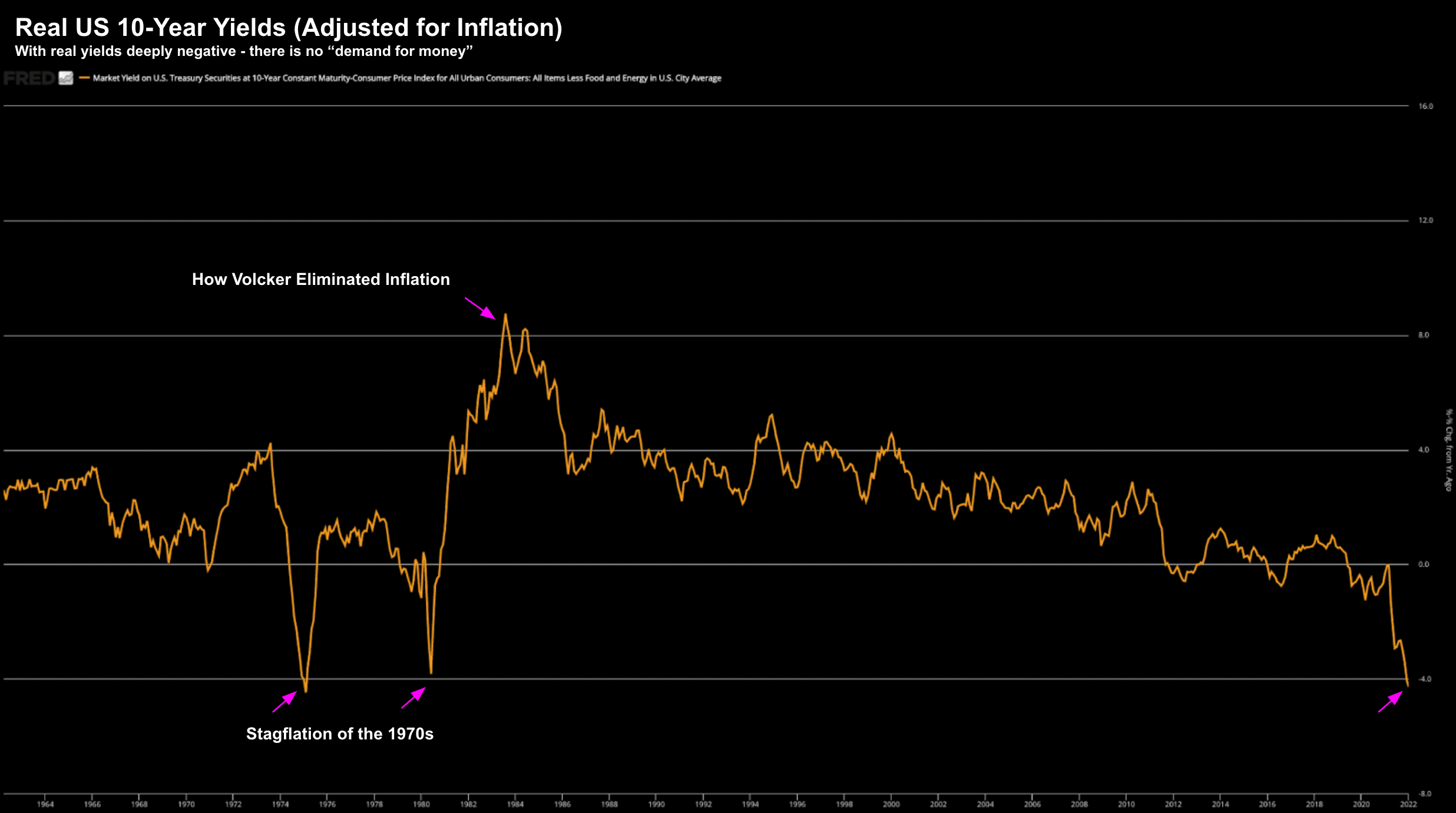

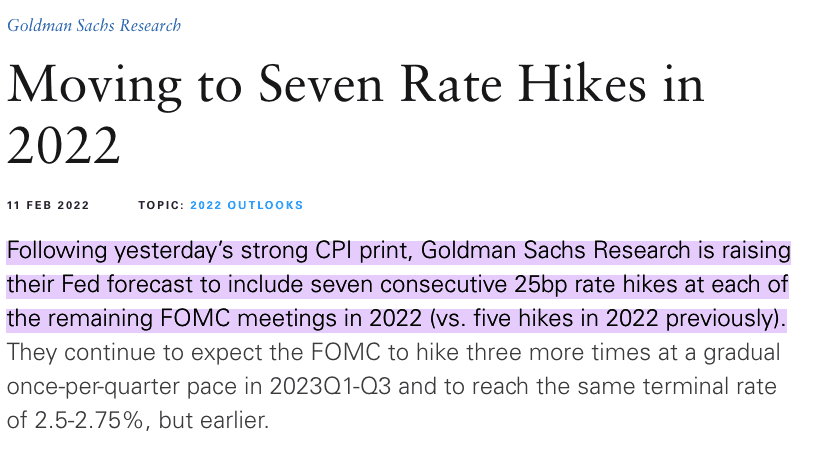

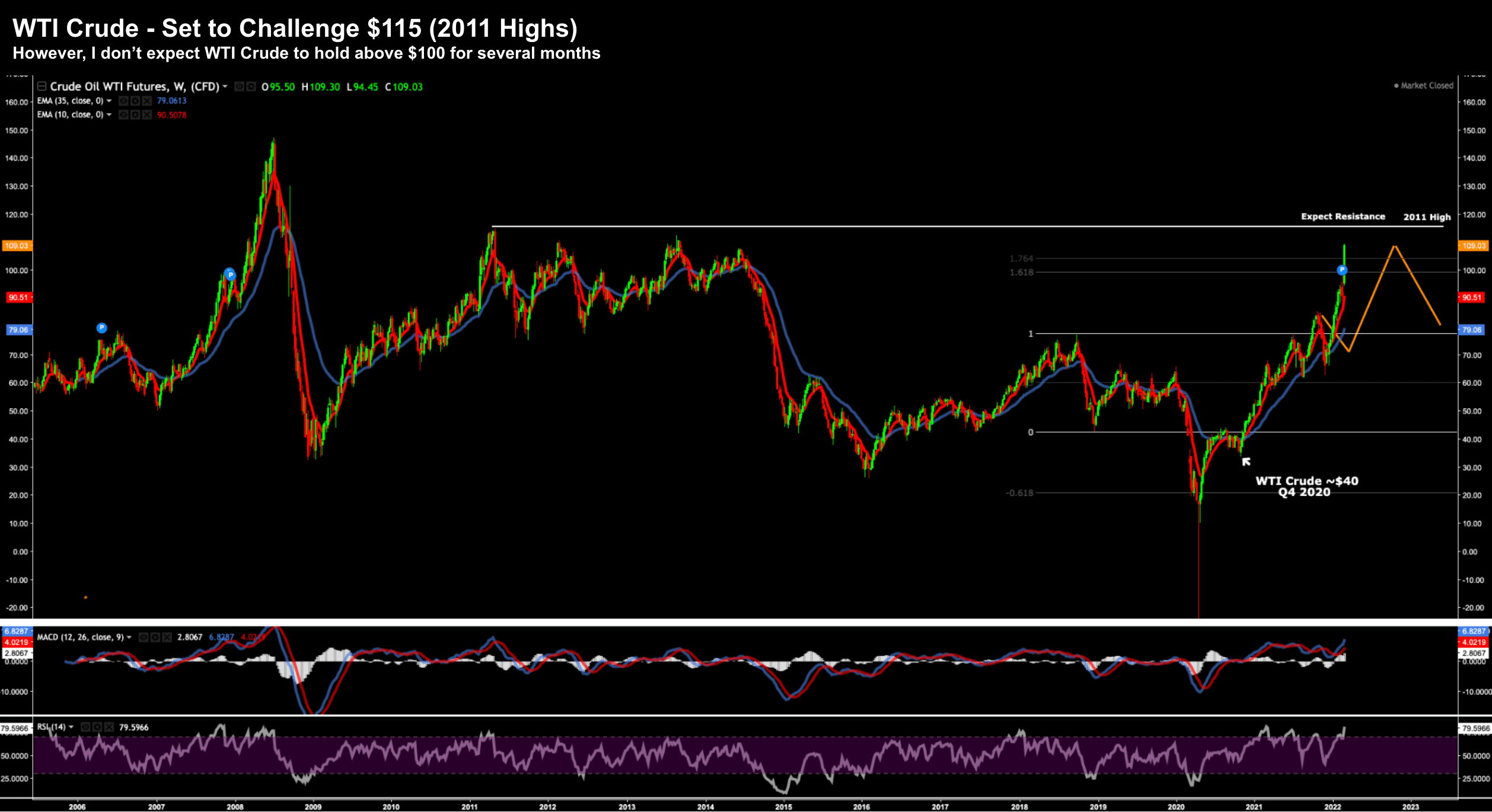

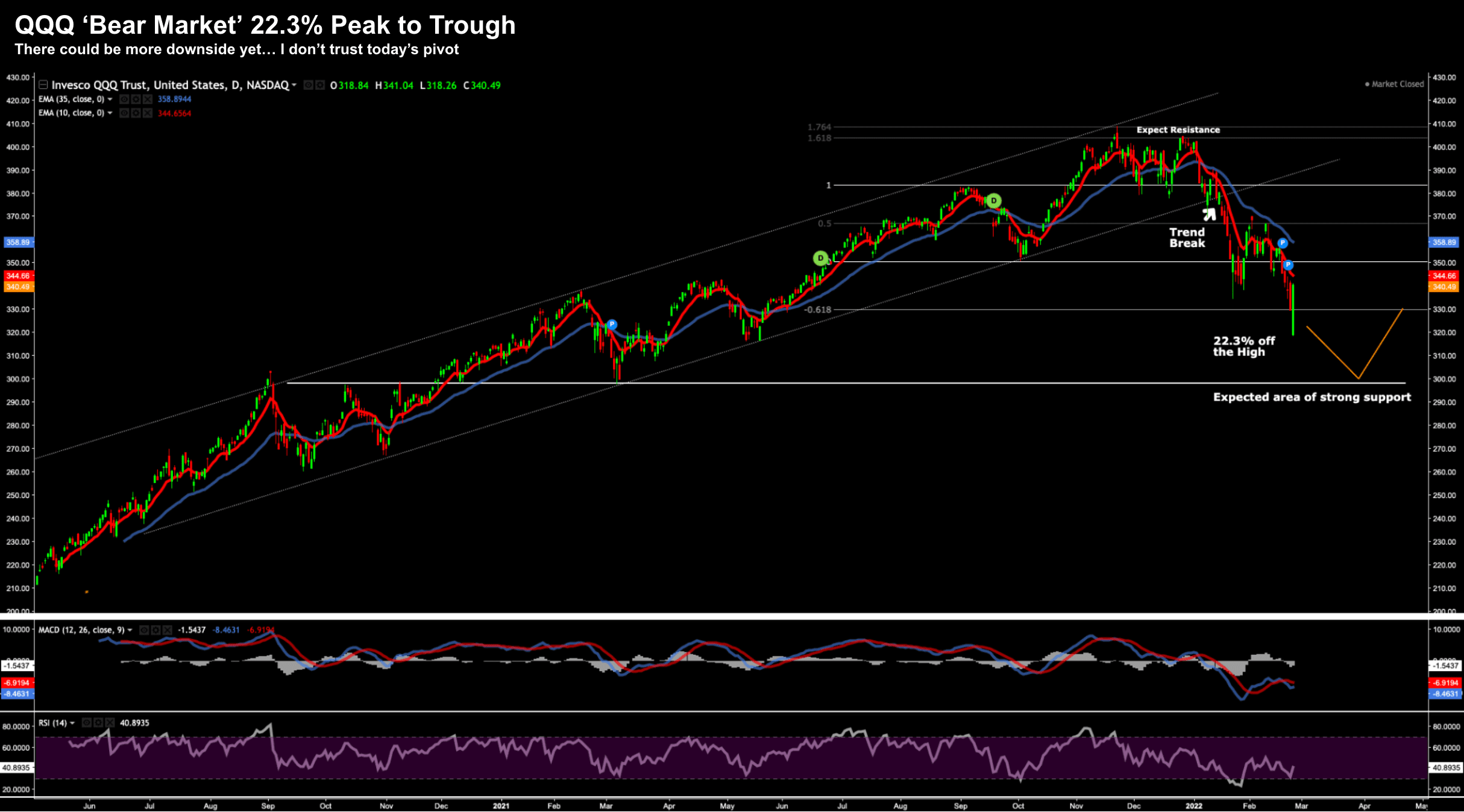

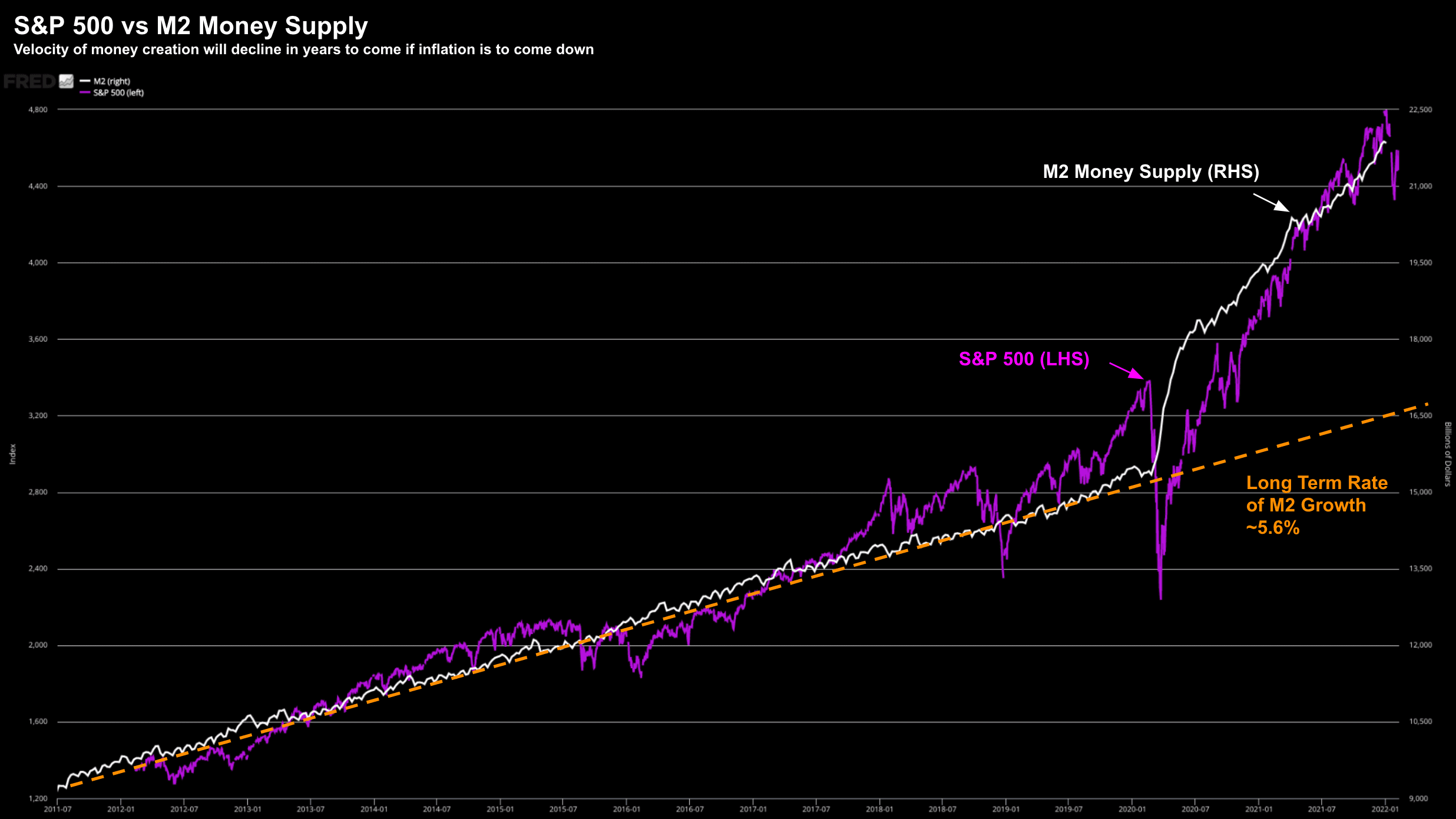

Market staged their best day in 2 years... with the Nasdaq up 3.6%. For now, this smells like a bear-market rally. We need to see more to add conviction the bottom is in for 2022...