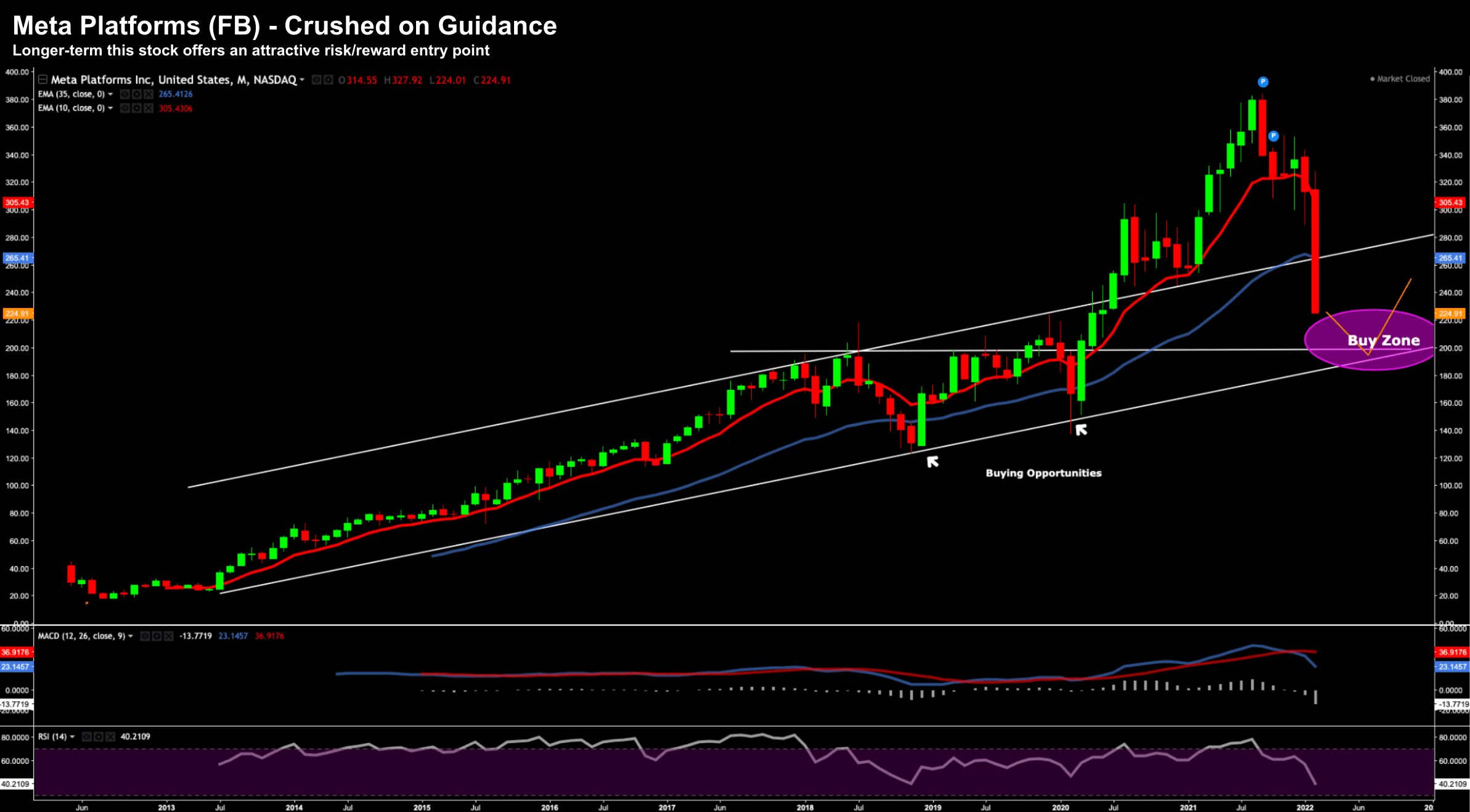

Do You Buy Meta Platforms (FB) Here?

Do You Buy Meta Platforms (FB) Here?

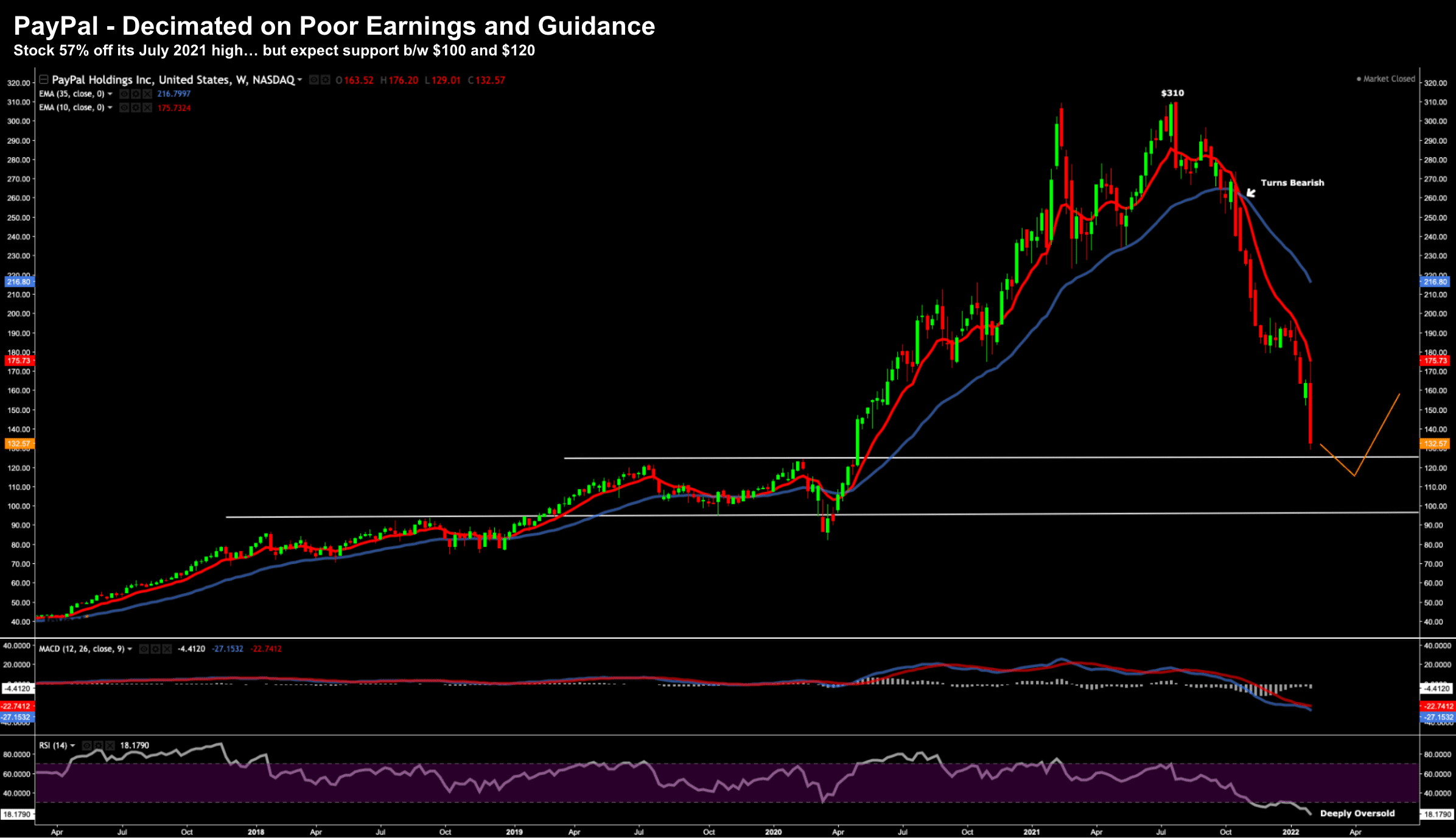

Tonight”s post focuses on the 41% slide in Meta Platform”s (i.e., Facebook) stock. Is this a buyable opportunity? Or is it one to avoid? My short answer is two-fold: (a) I think we could see a little more downside; however (b) if…