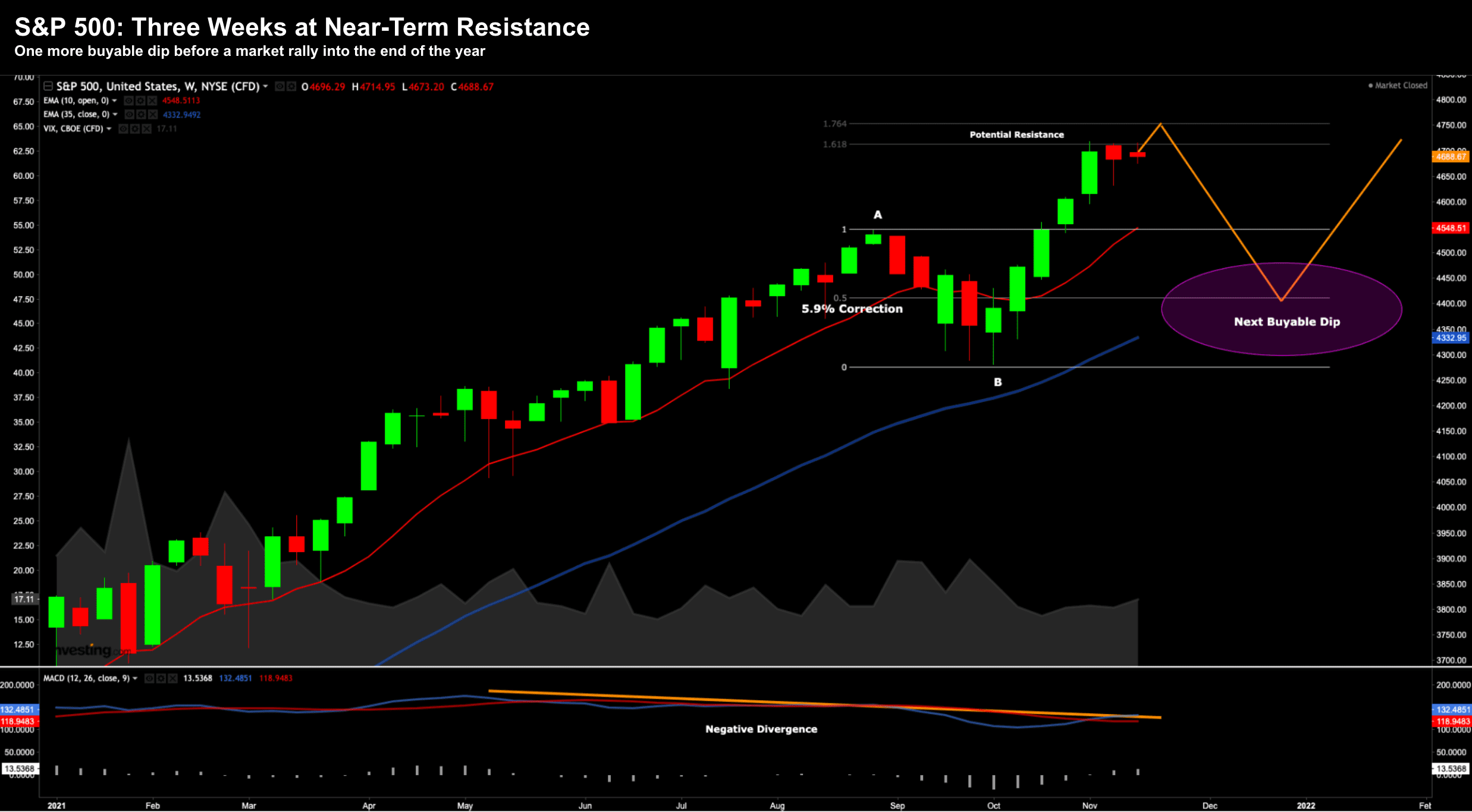

Ready to Buy the Dip?

Ready to Buy the Dip?

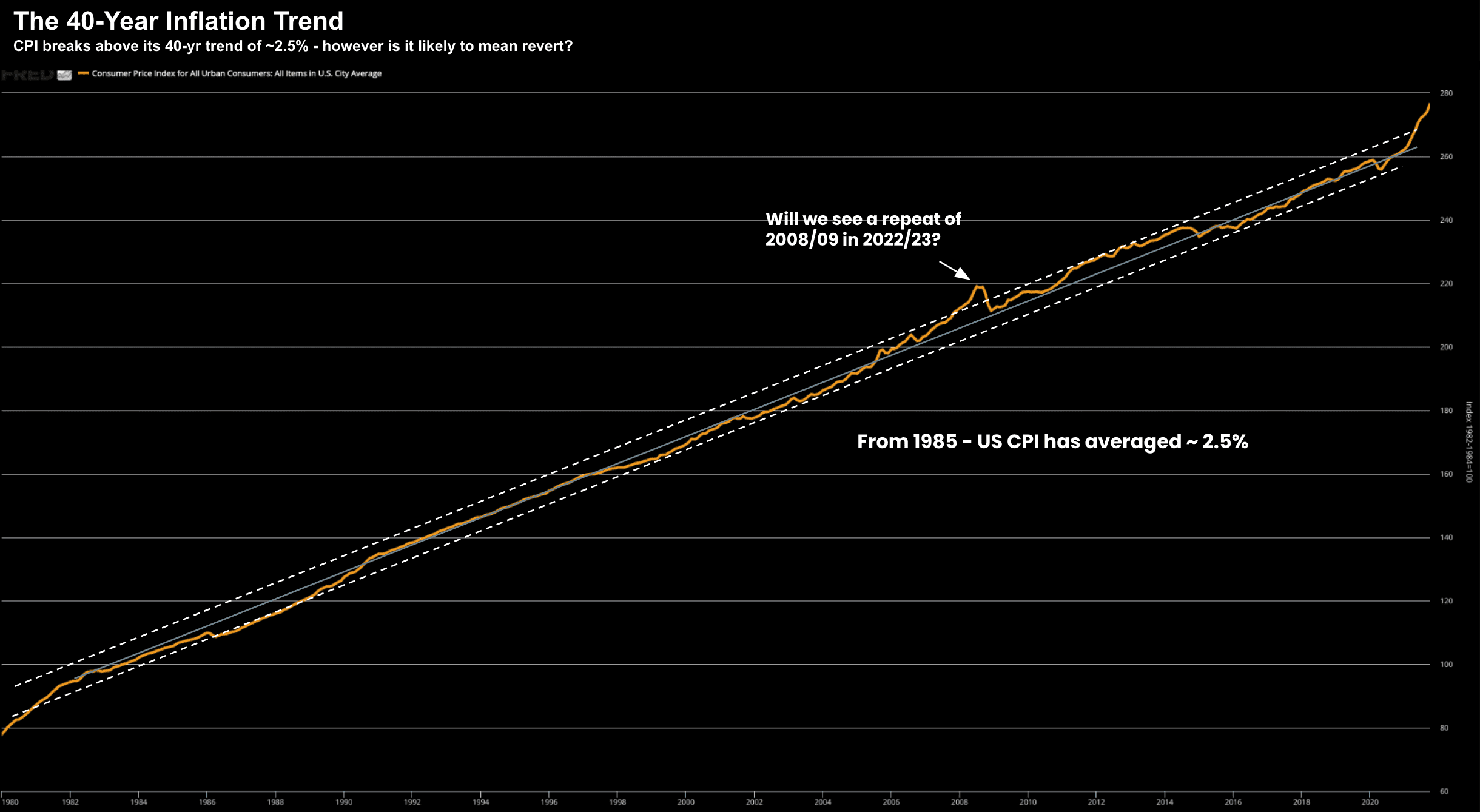

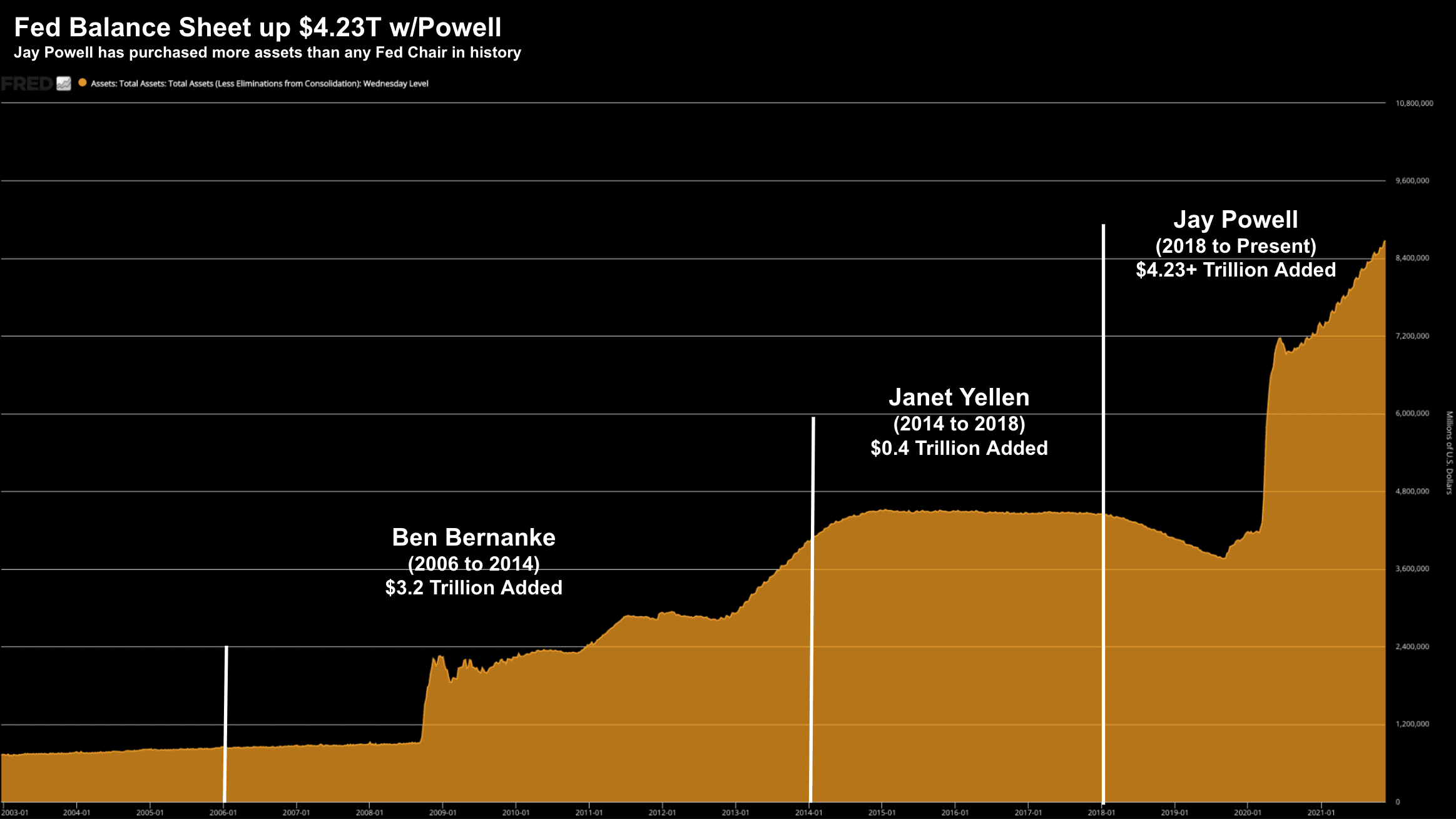

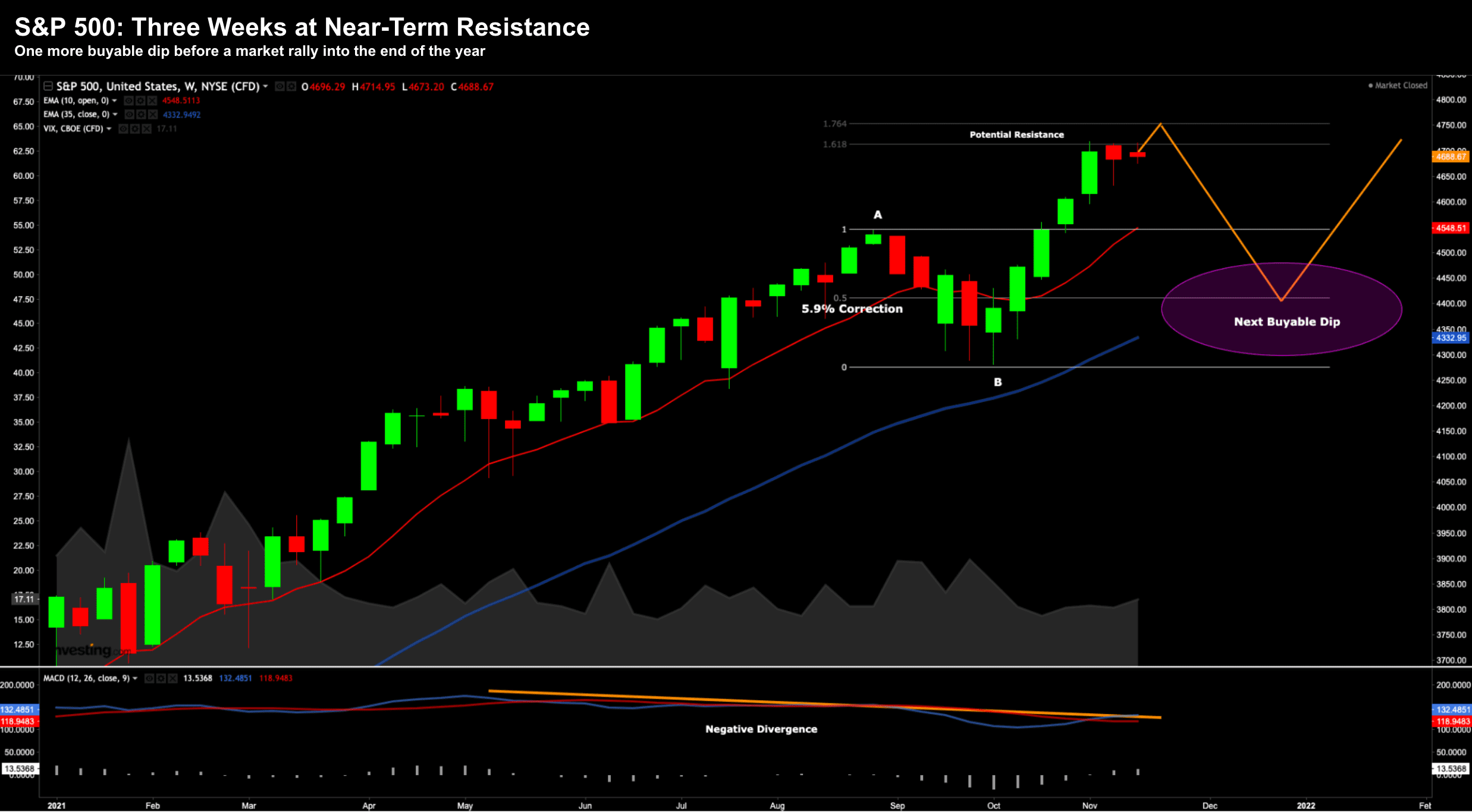

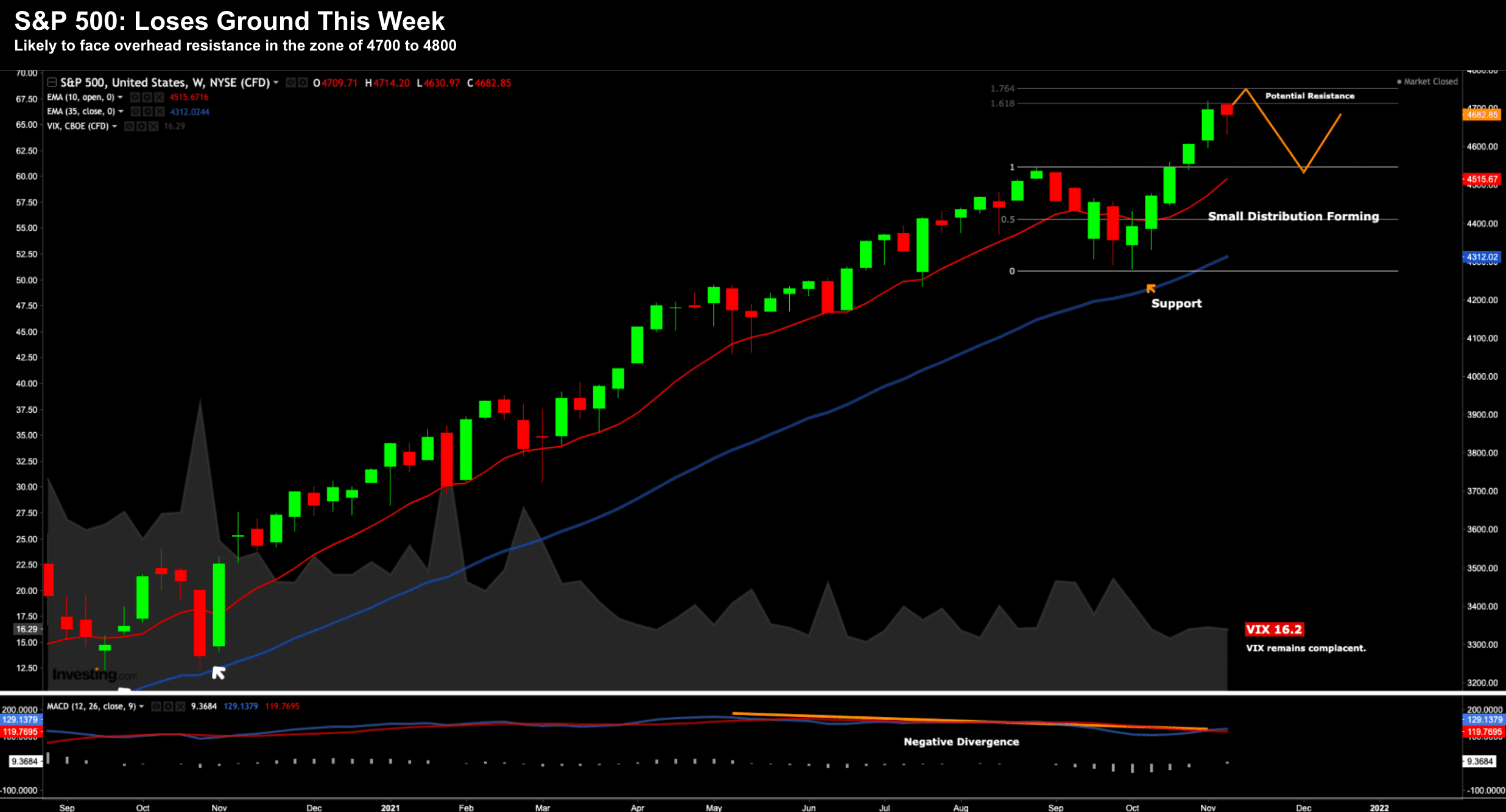

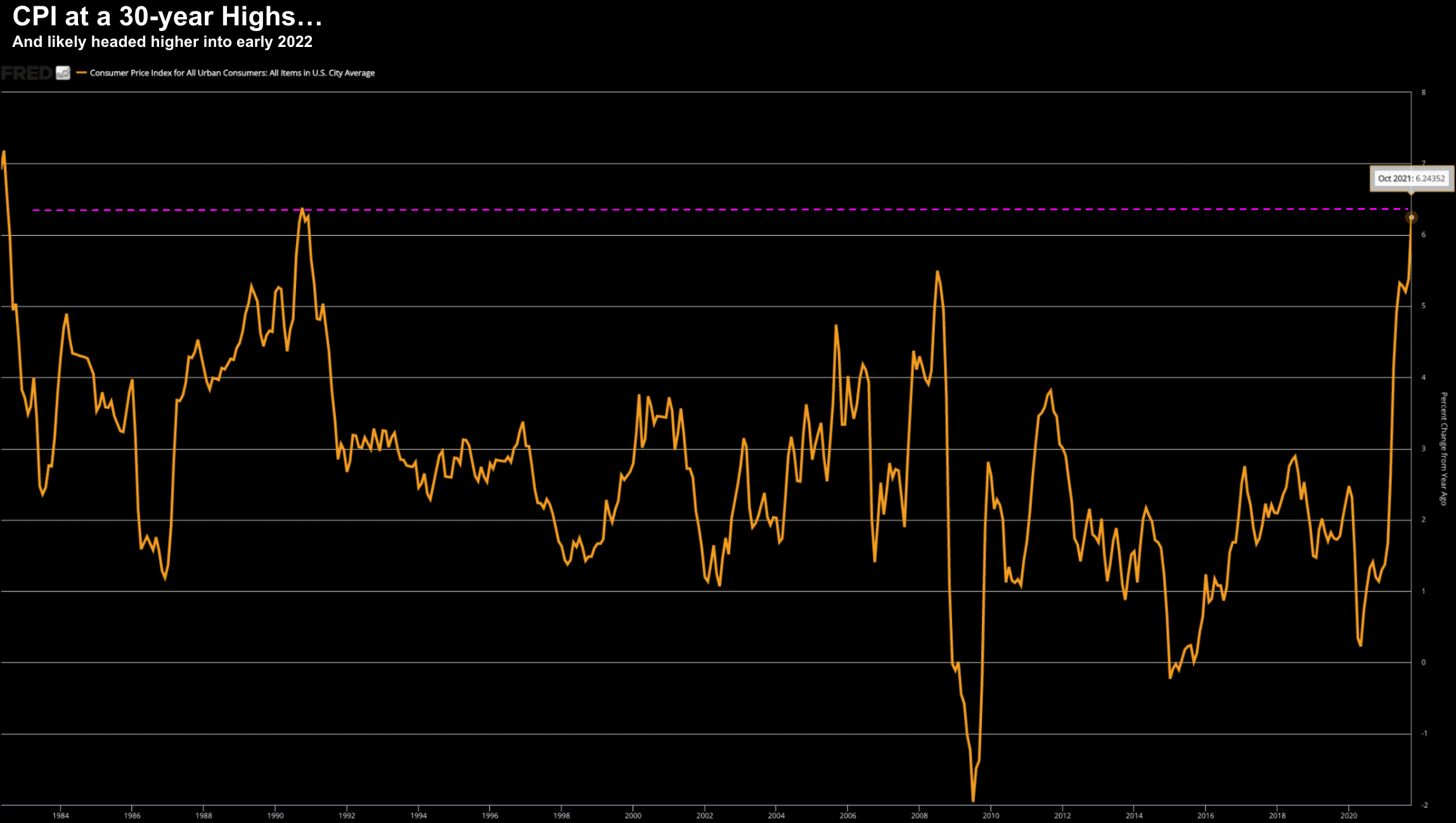

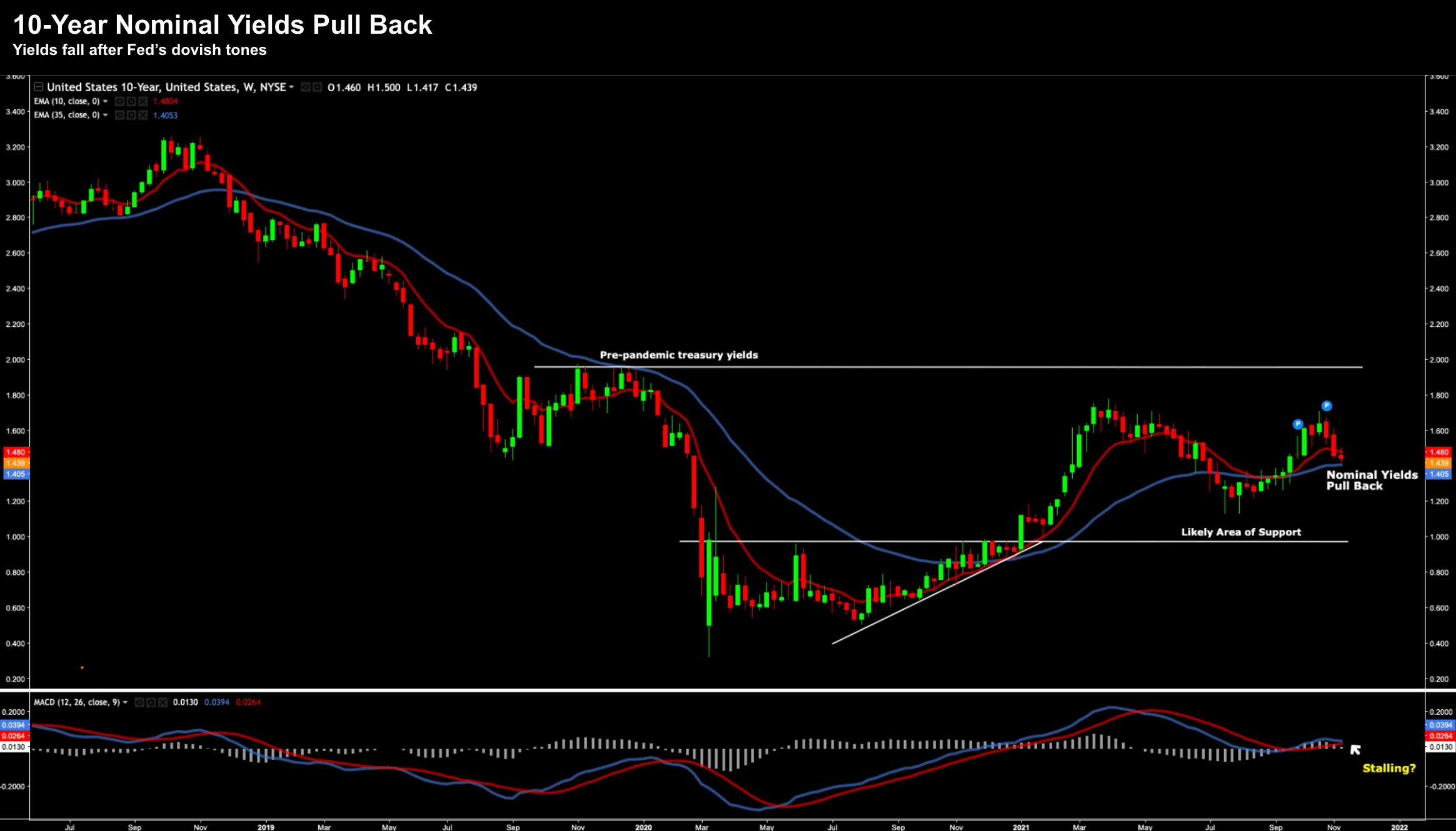

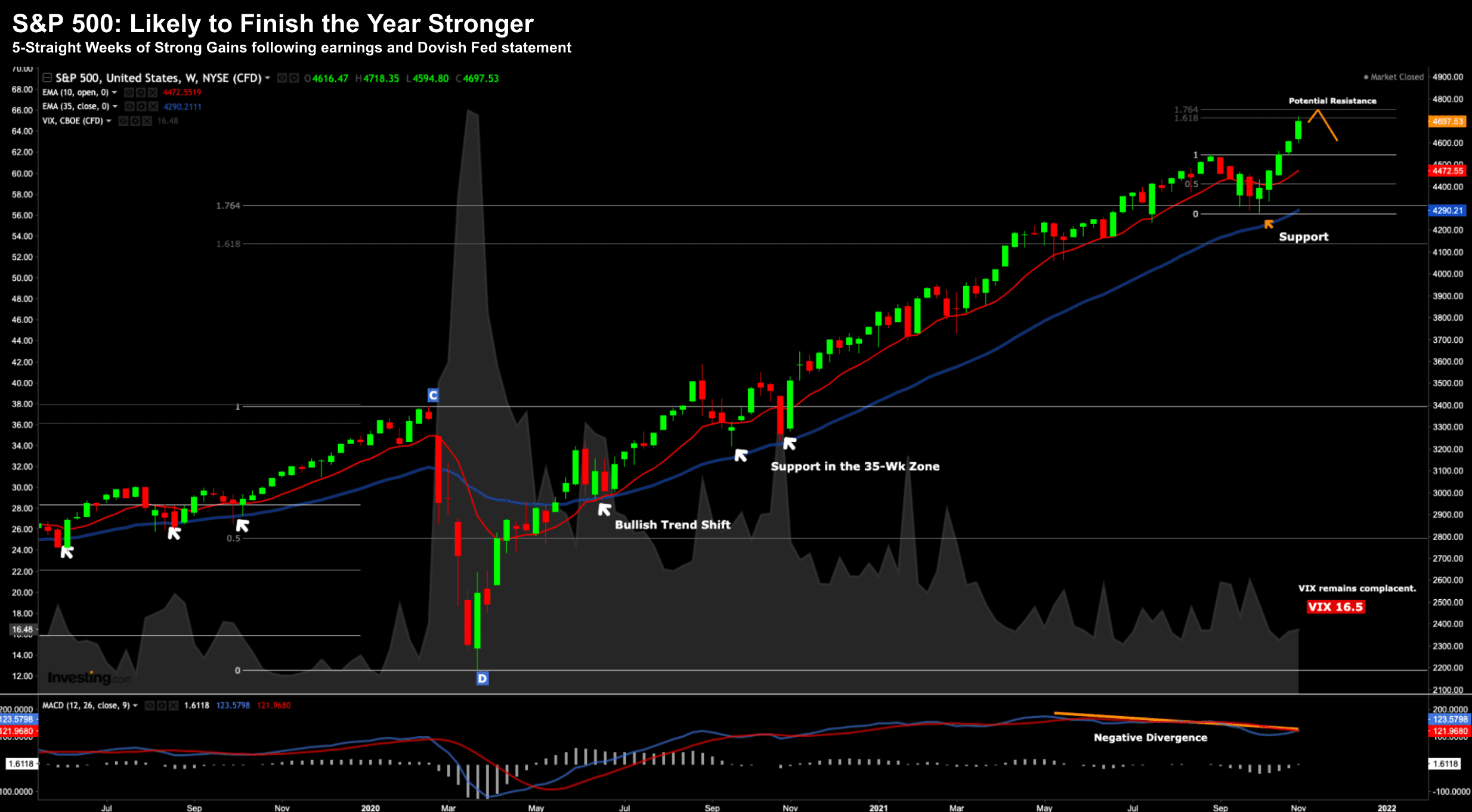

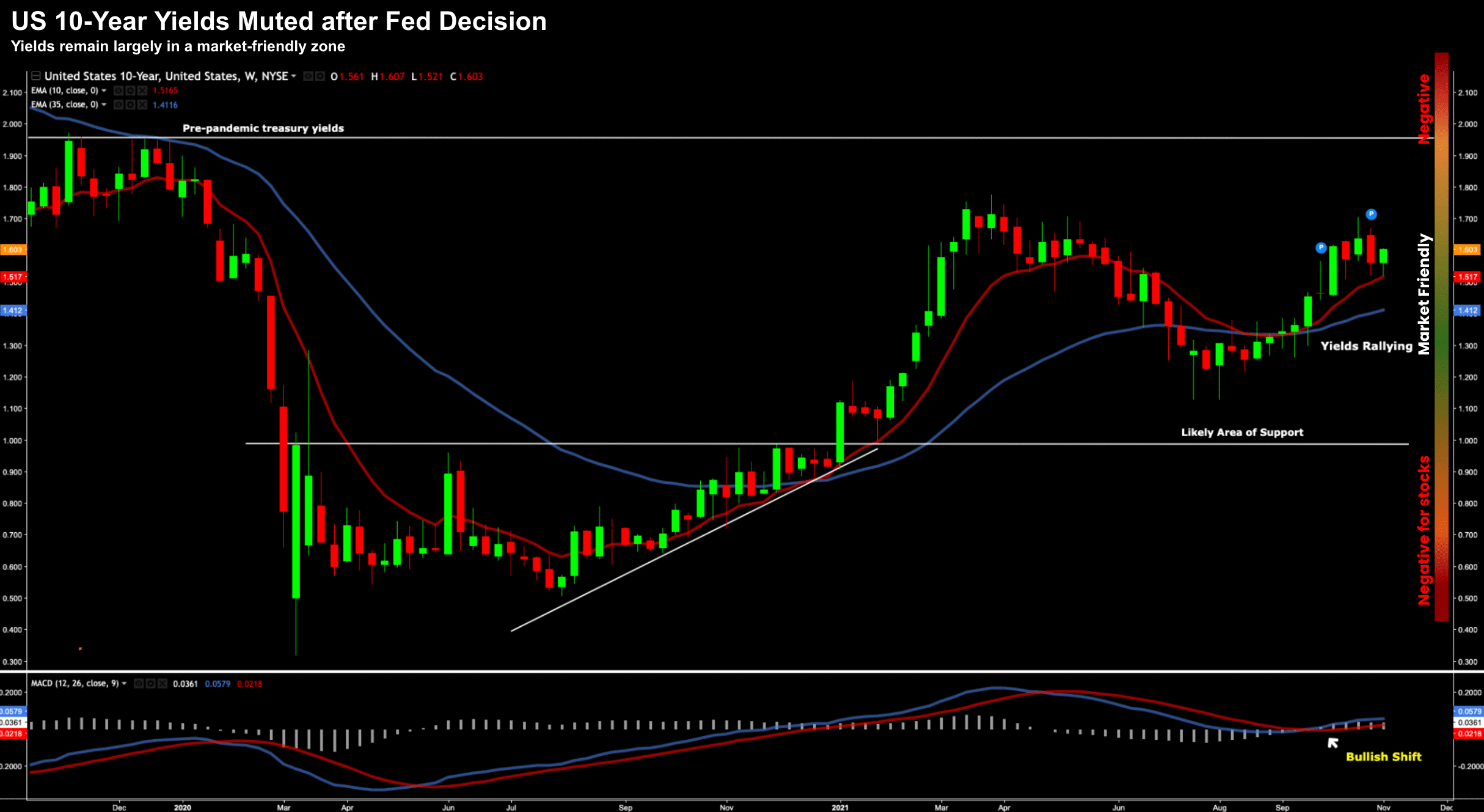

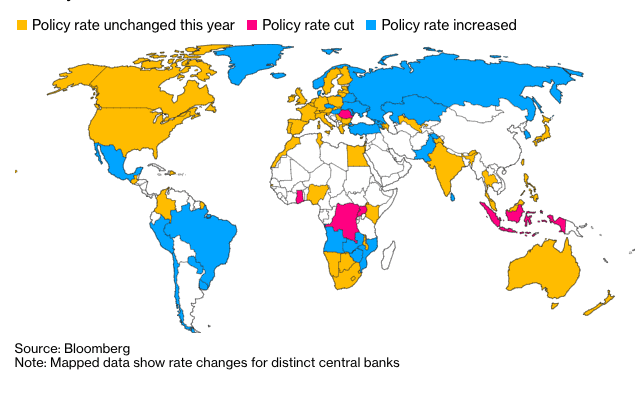

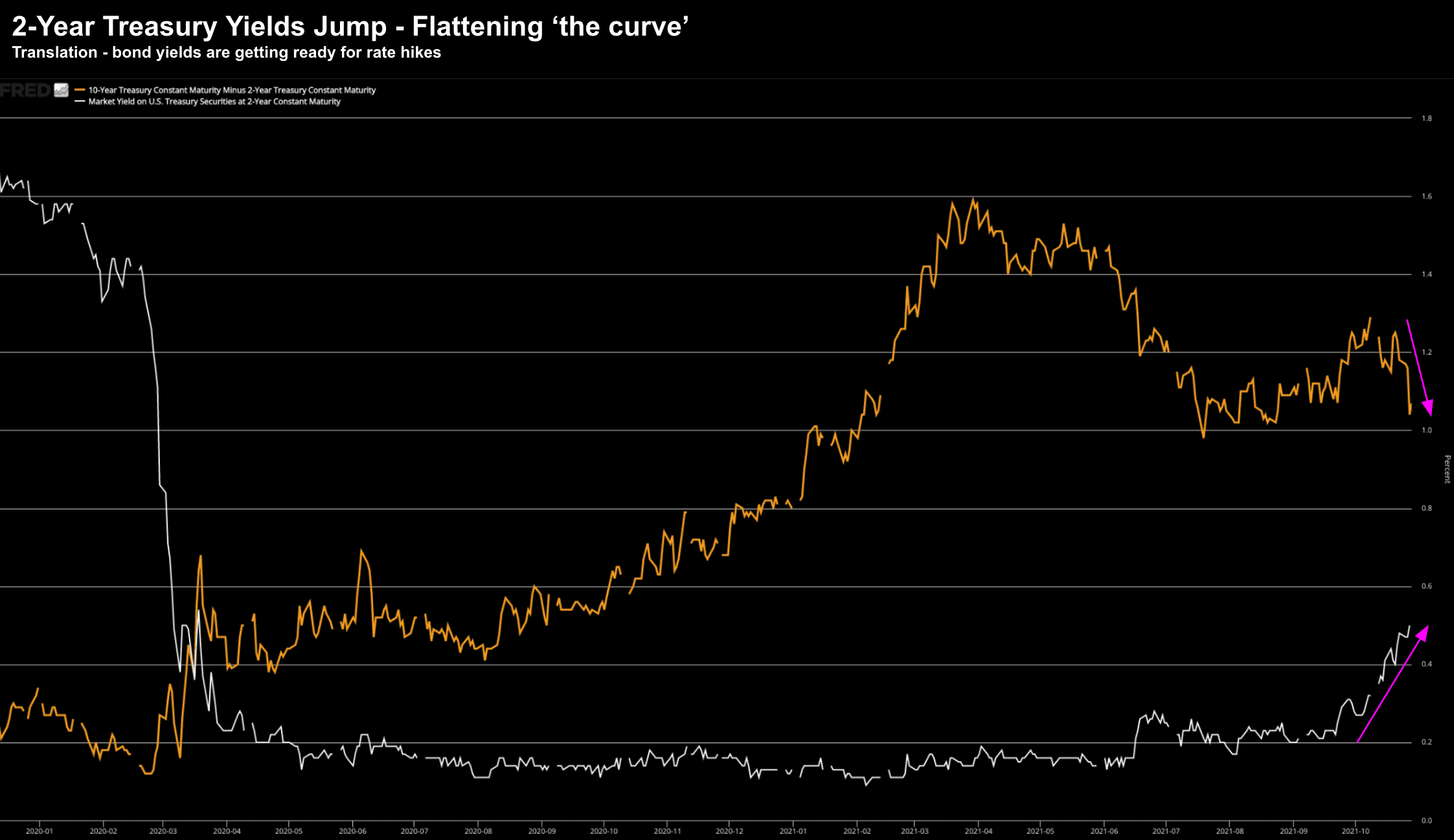

Of late, investors focused on risks surrounding unwanted inflation, central bank tightening and supply-chain snarls. The VIX lingered below 15 - a sign of complacency and what I felt was over-confidence. Overnight that changed...