The Ultimate Contrarian Signal

The Ultimate Contrarian Signal

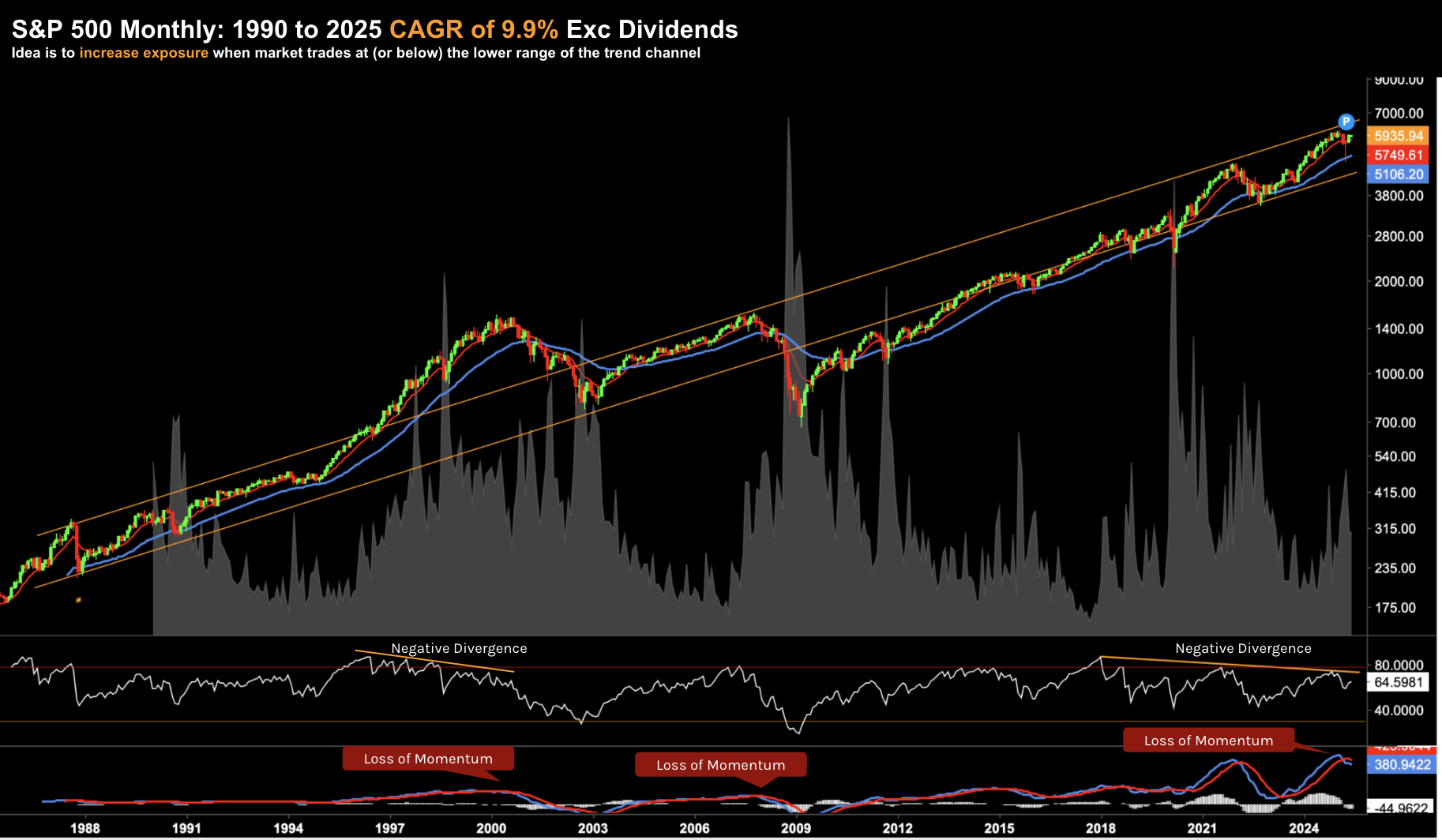

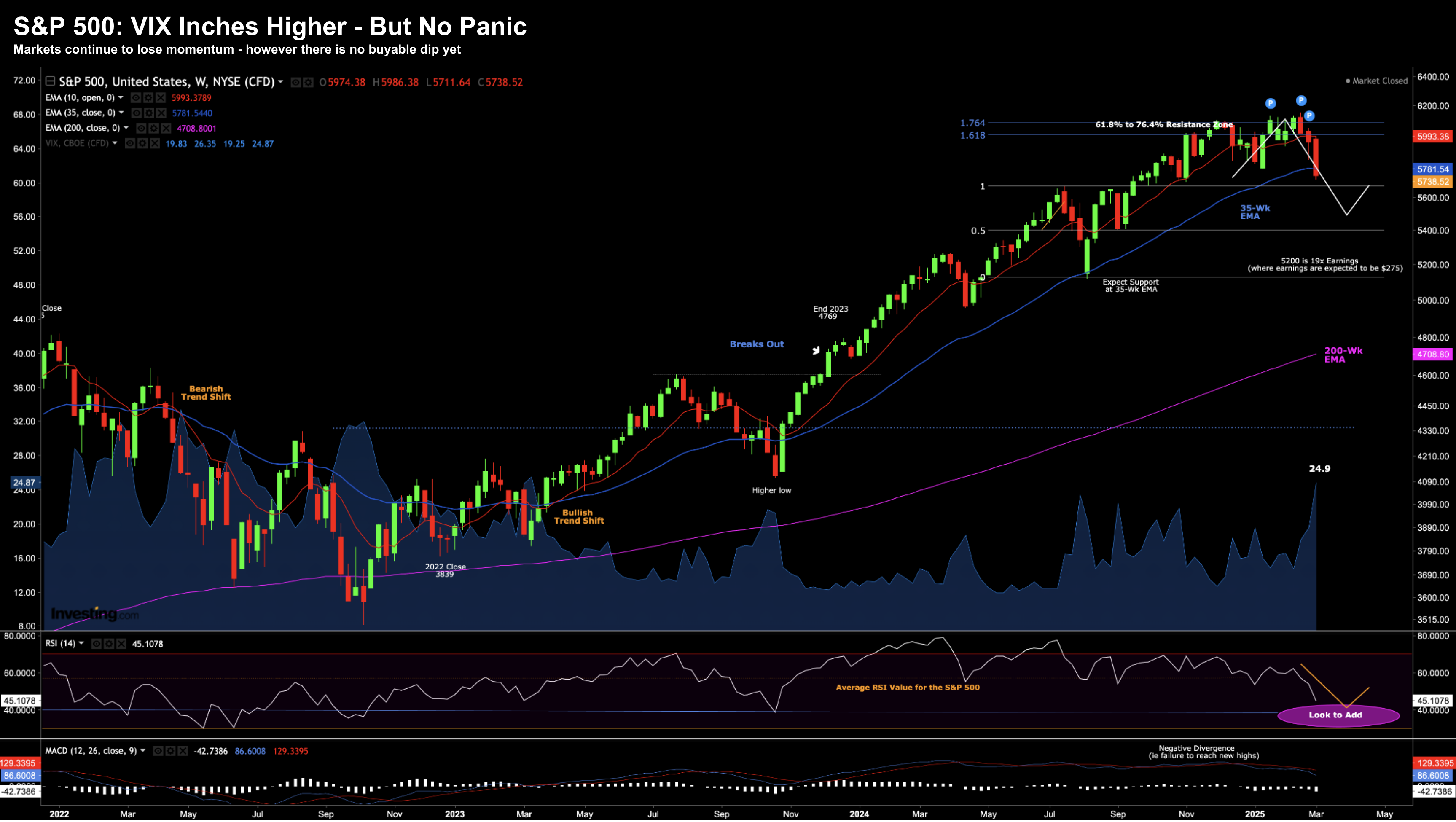

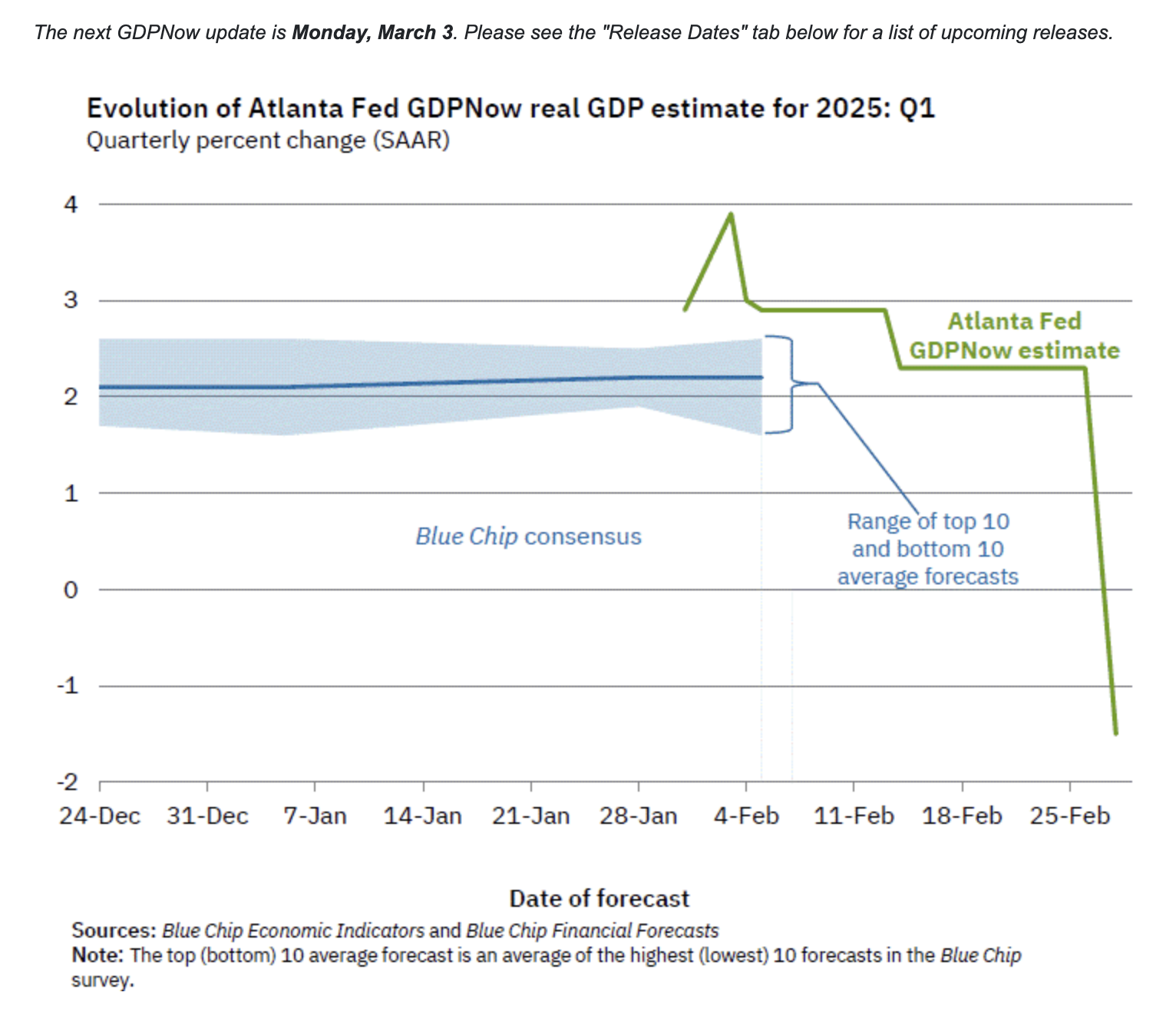

When the crowd leans one way, the boat is at risk of capsizing. With BofA’s Bull & Bear indicator triggering a contrarian "sell" signal and equity inflows hitting record highs, market participants are priced for a "Goldilocks" perfection that leaves zero margin of safety. While consensus bets on double-digit earnings growth and Fed cuts, a "Bear Steepener" in the yield curve suggests the bond vigilantes are revolting against a $1.6T deficit. If the US 10-year creeps higher, today’s 22x forward multiple faces a sharp reality check. I remain 65% long in quality, but patient for the correction.