Why Buffett’s Mentor Would Reduce Risk

Why Buffett’s Mentor Would Reduce Risk

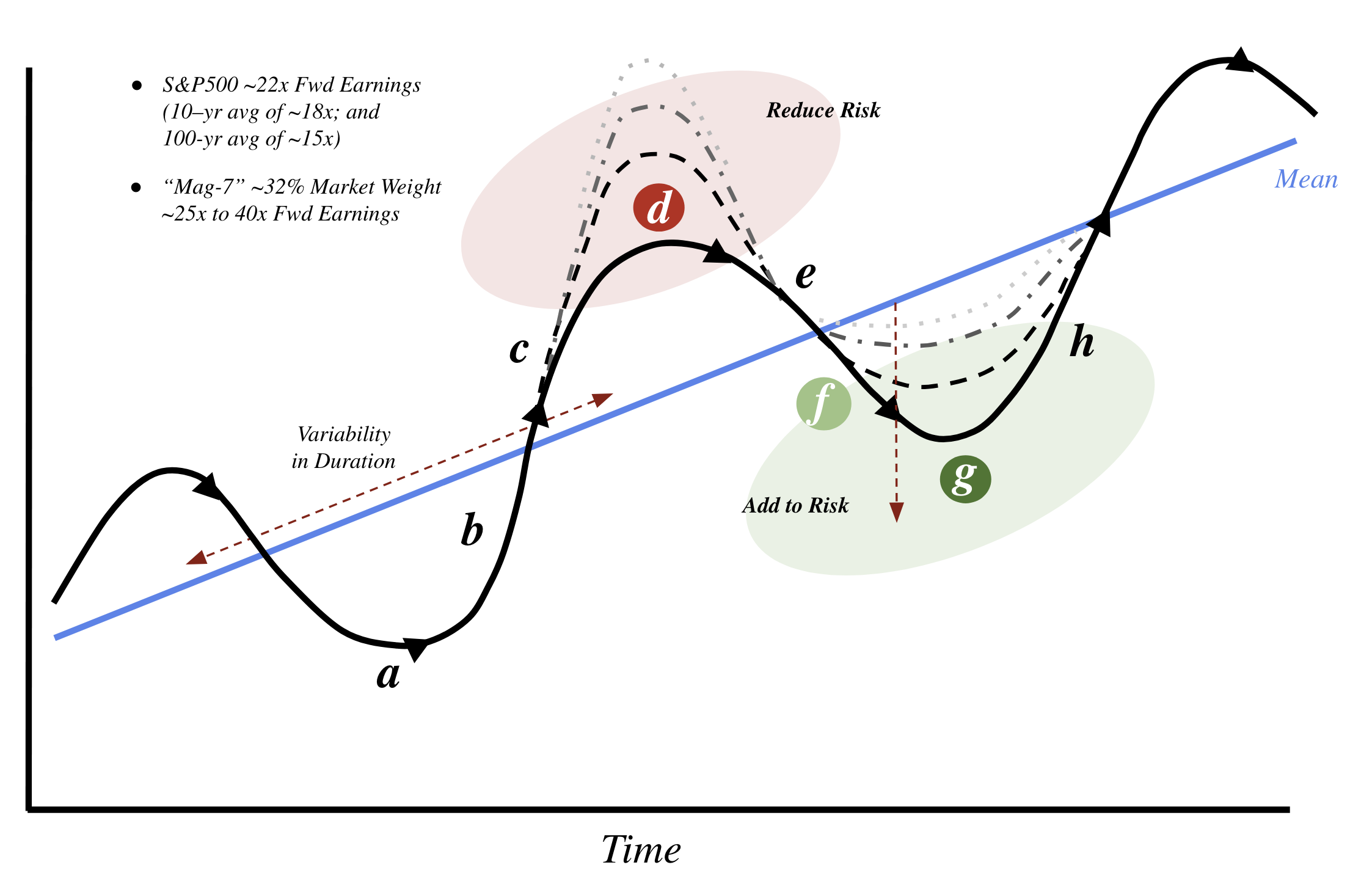

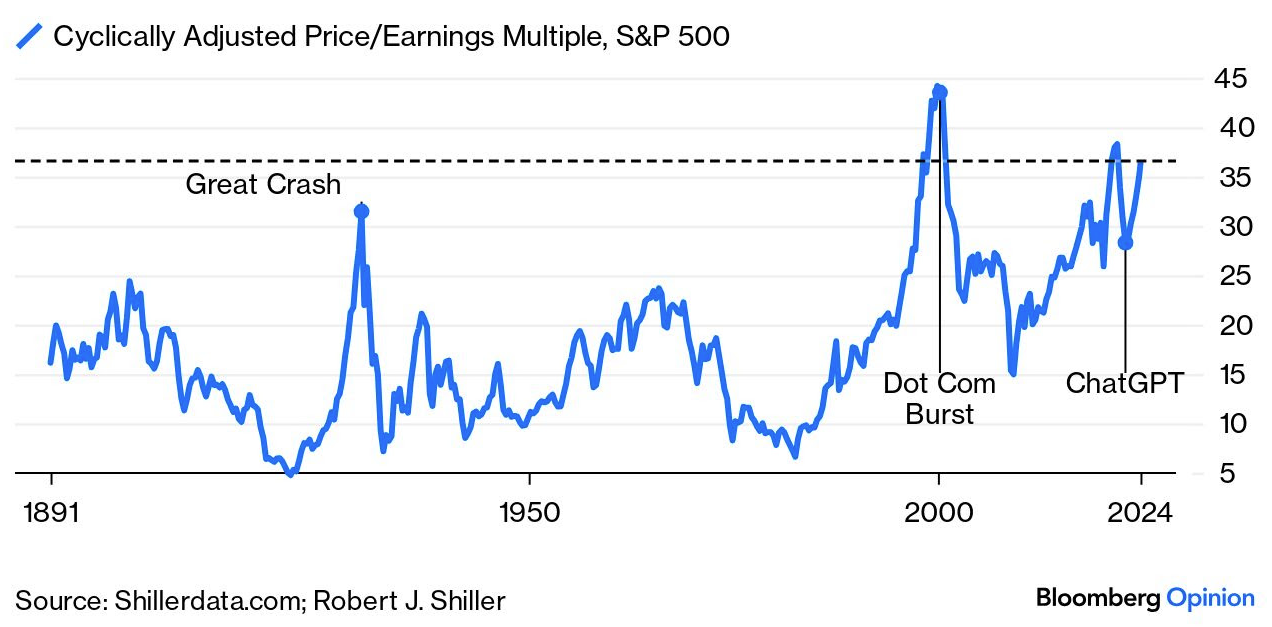

I've been re-reading "The Intelligent Investor" by Benjamin Graham. Warren Buffett called it "by far the best book on investing ever written" - crediting Graham with laying the foundation for his entire investment philosophy. The book taught me three powerful lessons: (1) above all else, investing is about protecting your capital; (2) investors should strive to pursue adequate and sustainable gains; and (3) it requires overcoming self-defeating behaviors (e.g., fear, greed and bias). The lessons could not be more timely given today's excessive valuations.